Balanced tactical management that seeks competitive total returns from a portfolio of income-generating securities with significantly reduced risk.

A macro-economic framework developed and monitored by the Investment Team that informs asset allocation and sector weightings.

Individual issue selection grounded in deep fundamental analysis, valuation, correlation, and other factors.

A 20-Year audited track record across a variety of market cycles.

Portfolio Managers: Bill Garvey, Alex Oxenham

Investment Vehicles: SMA, mutual fund with Direxion, and selected investment platforms.

“A lot of the success of Tactical Income has been where we haven’t been, in addition to where we have been.”

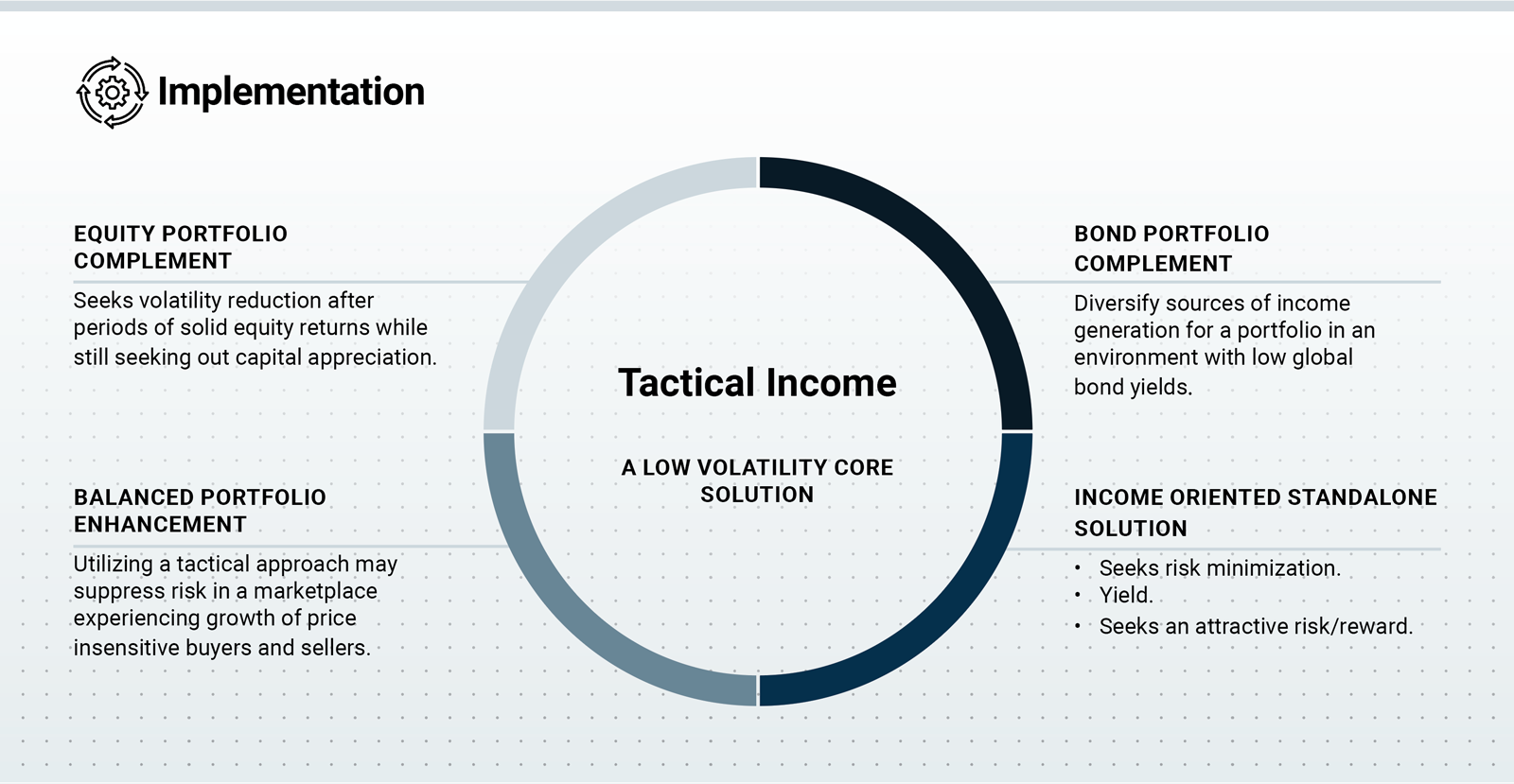

Tactical Income

Seeks volatility reduction after periods of solid equity returns while still seeking out capital appreciation.

Diversify sources of income generation for a portfolio in an environment with low global bond yields.

Utilizing a tactical approach may suppress risk in a marketplace experiencing growth of price insensitive buyers and sellers.

Equity Portfolio Complement

Bond Portfolio Complement

Balanced Portfolio Enhancement

Income Oriented Standalone Solution

HILTON CAPITAL

Decks and Factsheets

Take a deep dive into HCM's Tactical Income Strategy with a deck & factsheet on portfolio construction, risk-return profile, performance, & more. Get it today!

Last Updated March 31, 2024

Videos

In this video Hilton Capital Management's Investment Team discusses its flagship strategy Tactical Income and what makes it unique in the investment ecosystem.

February 17, 2021

Videos

Join Hilton Capital Management PM Alex Oxenham for a video discussion on where its flagship strategy Tactical Income fits into an investment portfolio.

February 17, 2021

The Tug of War Continues

April 06, 2023

Podcasts

Alex talks about Tactical Income strategies, how they work, and how to incorporate them into investment portfolios.

June 12, 2023

The Power of Easing Financial Conditions

July 14, 2023

Hilton reviews a nerve-wracking Q3 2023 with insights on rising interest rates, continued economic uncertainty, and Tactical Income Strategy positioning.

October 06, 2023

Hilton reflects on a tumultuous 2023: the U.S. economy, Fed policy, financial markets, and Tactical Income Portfolio performance.

January 11, 2024

Riding the Macro Wave

April 10, 2024

A six to 18-month outlook on macroeconomic factors, such as fiscal and monetary policy, interest rates, commodity pricing, and general business conditions, shapes broad allocations to fixed income, equity, and cash.

Sector weightings further reflect the Investment Team’s views on economic cycles, with an eye toward managing across earnings growth, quality, and more defensive consumer staples categories.

In addition to traditional fixed income securities, other income-producing securities in the portfolio can include dividend-paying common shares, preferred shares, and REITs, among others.

Individual securities are selected via a disciplined process based on deep fundamental analysis with a preference for companies with steady dividend growth, solid balance sheets, and industry leadership.

“It’s important to understand that this is more than “picking stocks” to complement a fixed income portfolio.”