HCM Insights

Navigating a Shifting Landscape: Defensive Repositioning and Selective Conviction in DIVYS 1Q25

The first quarter of 2025 brought a marked shift in the macroeconomic and geopolitical landscape, prompting a recalibration of our portfolio positioning within the Hilton Dividend & Yield Strategy (DIVYS). Against a backdrop of heightened policy uncertainty, increased market asymmetry, and signs of capital expenditure deceleration in key growth verticals, our investment committee took a more defensive posture while continuing to identify compelling opportunities in income-generating equities.

Macro and Market Backdrop

Early 2025 was defined by growing economic dislocations stemming from aggressive administrative reforms. Federal layoffs via the Department of Government Efficiency (DOGE), labor market pressures tied to immigration policy, and a notable slowdown in residential construction began weighing on broader economic momentum. Simultaneously, anticipation of "Liberation Day" — President Trump’s proposed blanket import tariff — added to market volatility and prompted global capital flow disruptions prior to and subsequently after quarter end.

From a corporate investment perspective, the DeepSeek AI breakthrough catalyzed a reevaluation of capital intensity across the datacenter value chain. Its lower compute requirements materially altered the growth trajectories for several AI hardware suppliers, prompting adjustments to our portfolio exposure.

Strategy Performance and Positioning

Following a strong year in 2024, DIVYS entered 2025 with a constructive yet cautious outlook. Our high-quality, income-oriented framework allowed us to avoid several major drawdowns across speculative and overvalued sectors. While absolute returns were modest, relative performance held up well given our shift toward more stable, cash-generative names.

Throughout the quarter, we maintained a portfolio yield north of 2.3%. We leaned further into names exhibiting defensible margins, durable cash flow, and shareholder-aligned capital allocation policies, particularly as market volatility reaccelerated.

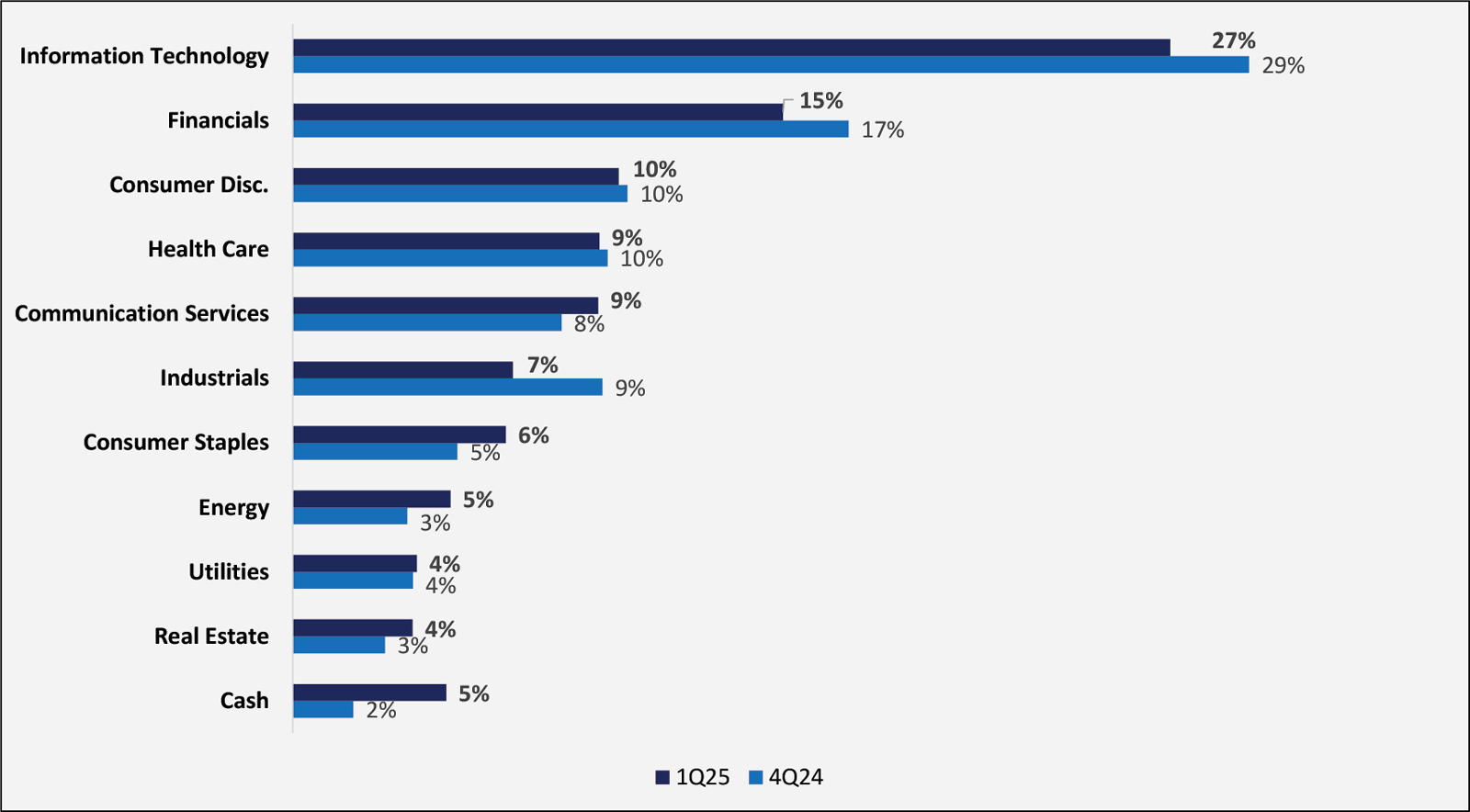

Figure 1: DIVYS 1Q25 v. 4Q24 Sector Weights

Figure 1: DIVYS 1Q25 v. 4Q24 Sector Weights

Source: Bloomberg

Importantly, the strategy’s international equity exposure — which we began increasing steadily in mid-2024 — reached approximately 10% by the end of the first quarter. This diversification effort has helped reduce reliance on U.S.-centric economic and policy outcomes, particularly given the evolving tariff landscape and redirection of trade flows away from the U.S. Our holdings in European and Japanese multinationals have not only enhanced portfolio resilience but also introduced differentiated sources of income and valuation support. We further increased our international allocation in early 2Q25 following "Liberation Day," as part of a broader initiative to mitigate domestic policy risk and gain exposure to more stable macro environments abroad.

Market Tailwinds During 1Q25:

- Continued Deregulation Expectations.

- Inflation: Core PCE at 2.8% (Decelerating from Jan.).

- Stable Energy Prices.

- 4Q24 Real GDP at 2.4%.

- Loosening Financial Conditions: 2YR / 10YR down ~35bps.

Market Headwinds During 1Q25:

- AI-CapEx Spend Potentially Overheating.

- Widening Credit Spreads (3.5% HY spreads from <3% in Jan.).

- Rising Trade Uncertainty.

- Extended Valuations (SPX trading +22x NTM EPS).

- Federal Employee Reduction / DOGE-related Spending Cuts.

DIVYS Strategy 1Q25 Review:

As illustrated in Figure 1, sector exposure adjustments during the first quarter reflected a more cautious stance in response to emerging risks. Most notably, we reduced our overweight in Industrials from 9.4% to 6.7%, a decision driven by weakness in short-cycle names and ongoing uncertainty tied to corporate restructuring events. At the same time, we lowered our Financials allocation modestly to 14.9% (v. 16.9%), reflecting the exit of less compelling U.S. banks and increased scrutiny of private credit valuations.

Exposure to Communication Services and Health Care rose slightly, while Information Technology remained our largest weight, albeit reduced from Q4. We increased our allocation to Consumer Staples from 5.0% to 6.5%, driven by our conviction in low-volatility franchises such as Procter & Gamble.

Our allocation to Cash grew to 4.7%, reflecting both elevated market uncertainty and our desire to retain flexibility to take advantage of dislocations in the months ahead. Overall, these tactical adjustments aimed to enhance downside protection while maintaining upside participation through select high-conviction holdings.

Performance: DIVYS delivered a return of -0.85% gross (-0.98% net) in the first quarter of 2025. While this modest decline reflects the broader shift in investor sentiment and elevated volatility, the strategy tracked closely with its benchmark, which returned +0.36% over the same period. While we modestly underperformed our primary benchmark, we remain pleased with the outcome given the benchmark's inherent defensive tilt and bias toward low-growth, high-dividend stocks—an asset class that historically outperforms in down markets. In contrast, the S&P 500 posted a loss of -4.27% for the quarter, reflecting its higher exposure to long-duration, low-yielding technology stocks. Although we are not benchmarked to the S&P 500, we view our strategy as a blend between traditional dividend-focused portfolios and higher-growth indices. As such, we aim to remain competitive across both styles over the long term, and our significant outperformance versus the S&P 500 underscores our success in capturing upside while mitigating downside risk.

Figure 2: DIVYS 1Q25 Performance Relative to Benchmark*

Figure 2: DIVYS 1Q25 Performance Relative to Benchmark*

Source: Bloomberg

Portfolio Adjustments

AI Hardware Realignment: We meaningfully reduced exposure to AI hardware vendors most exposed to datacenter CapEx deceleration. Specifically, we trimmed our positions in Broadcom (AVGO) and Taiwan Semiconductor (TSM) and fully exited Schneider Electric (SBGSY). These moves reflected our view that the efficiency gains of DeepSeek’s model would weigh on GPU demand and moderate the AI infrastructure investment cycle.

Selective Additions in AI-Enabled Software and Platforms: In contrast to hardware, we increased our position in Meta Platforms (META), which we believe stands to benefit from DeepSeek’s model by scaling LLaMA more cost-effectively. We also added to Cisco Systems (CSCO), a beneficiary of datacenter diversification and AI-related networking demand, particularly after its collaboration announcement with Meta and Arista. Oracle (ORCL) was also increased following strong fundamental momentum and raised forward guidance, reaffirming our conviction in its unique position within hyperscale infrastructure.

Sector Repositioning: Industrials, Telecom, and Energy Infrastructure:

- We exited Honeywell (HON) as its short-cycle industrial headwinds and pending spin-off created downside risk with limited near-term catalysts.

- We fully exited Booz Allen Hamilton (BAH) following downward estimate revisions tied to anticipated federal spending reductions. The position was initially trimmed earlier in the quarter.

- We trimmed Accenture (ACN) due to valuation and near-term macro sensitivity, while reallocating to higher-conviction names within the sector.

- We initiated positions in Emerson Electric (EMR) and Motorola Solutions (MSI). EMR’s shift toward higher-growth automation and software provides a cleaner growth profile, while MSI’s law enforcement focus and capital discipline align well with our defensive compounding growth focus.

- Within telecom, we established a new position in T-Mobile (TMUS), attracted by its 5G leadership, capital return strategy, and defensive growth characteristics.

- We trimmed our position in the Communication Services Select Sector SPDR Fund (XLC) to reallocate toward higher-conviction individual opportunities like TMUS, while modestly increasing portfolio yield.

- We added Williams Companies (WMB), favoring its natural gas infrastructure exposure to rising AI power demand and its steady dividend growth outlook.

- We increased our position in Xylem (XYL), a pure-play water infrastructure company with solid order momentum and margin expansion potential despite short-term FX headwinds.

- We initiated a position in Prologis (PLD), viewing it as a key beneficiary of AI-driven data center demand and resilient logistics growth with an attractive dividend profile.

- We exited Lockheed Martin (LMT) following operational missteps and concerns about its positioning in next-generation defense programs.

Reallocation within Healthcare and Financials:

- We exited UnitedHealth (UNH) and Goldman Sachs (GS) while trimming Wells Fargo (WFC), and Bank of America (BAC), citing regulatory risk, extended valuations, and weak capital markets activity.

- Exposure to private credit / alternatives was trimmed with reductions in Apollo (APO) and Ares (ARES), though we later added back modestly to ARES after a correction.

- ICE (Intercontinental Exchange) was increased, reflecting its high-quality recurring revenues and operating leverage to equity market volatility.

Defensive Consumer Staples Rotation:

- We increased our position in Procter & Gamble (PG), viewing it as a low-volatility compounder with resilient demand trends insulated from weight-loss drug headwinds impacting peers.

Global Diversification Initiatives:

- We initiated a position in 3i Group (TGOPY), a long-duration European private equity compounder anchored by its stake in discount retailer Action.

- We added to Itochu Corp. (ITOCY), a Japanese trading house with low commodity sensitivity, rising ROE, and a shareholder-friendly capital return framework.

Quick Snapshot of 1Q25 Attribution:

- Average allocation to cash was up at 2.78%, however, new positions were primarily funded with existing positions.

- Yield on the portfolio as of 03/31/2025 was 2.35% and the 1-year Beta was 0.86.

- DIVYS returned -0.85% gross (-0.98% net) for 1Q 2025, which was 52 bp behind the benchmark return*.

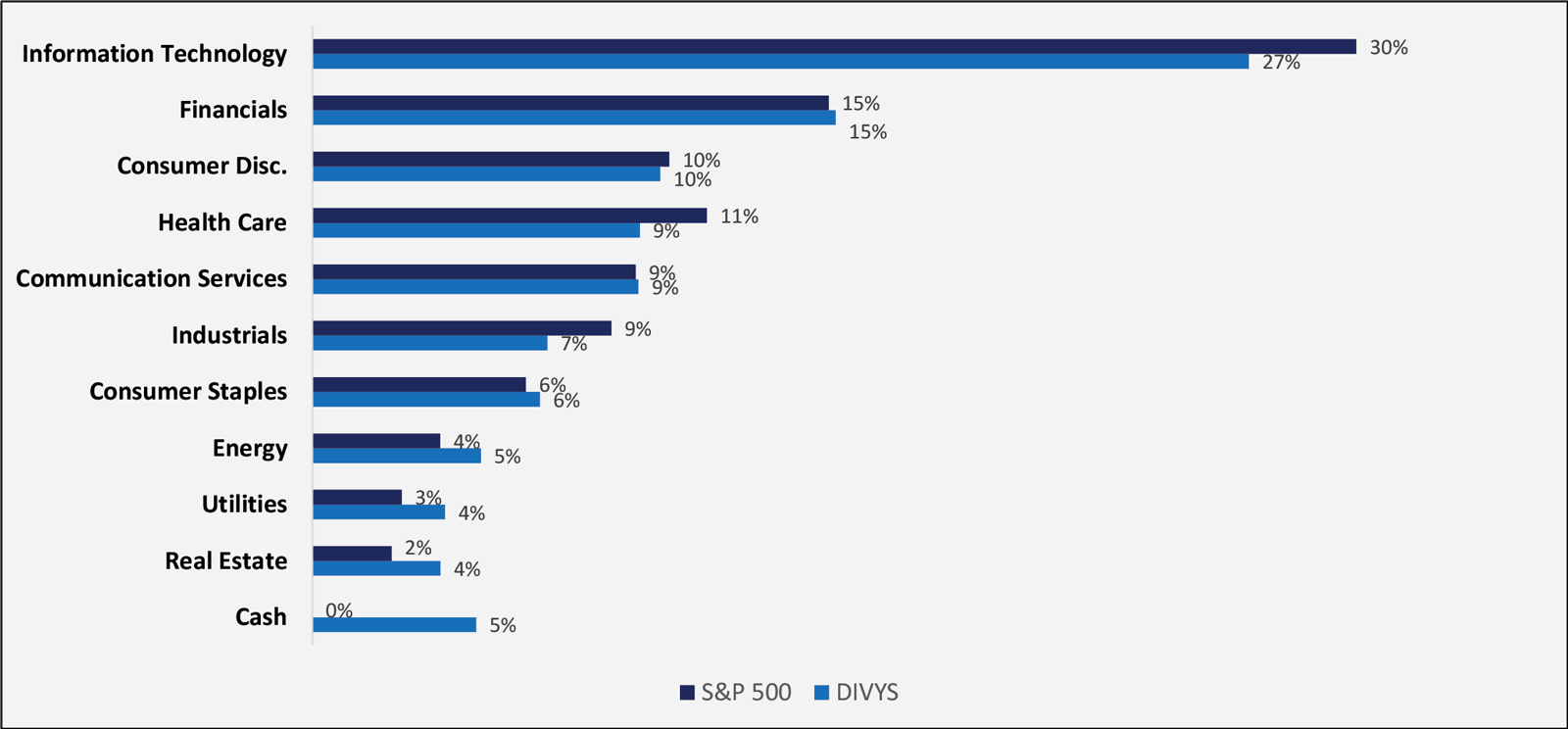

- Relative to the Nasdaq US Broad Dividend Achievers (DAATR), DIVYS was overweight Information Technology, Consumer Discretionary, Communication Services, Energy, and Real Estate.

- Relative to the Nasdaq U.S. Broad Dividend Achievers (DAATR), DIVYS outperformed in Consumer Staples, Industrials, Energy, and Healthcare for 1Q25.

- For 1Q25, top single-name contributors included Philip Morris (PM), Republic Services (RSG), Waste Management (WM), Chevron (CVX), Eli Lilly (LLY), AstraZeneca (AZN), Quest Diagnostic (DGX), Amgen (AMGN), Darden Restaurants (DRI), International Business Machine (IBM).

- For 1Q25, top single-name detractors included NETAPP (NTAP), Taiwan Semiconductor (TSM), Fidelity Consumer Discretionary ETF (FDIS), META Platforms (META), United Healthcare (UNH), Emerson Electric (EMR), Lockheed Martin (LMT), Booz Allen (BAH).

- DIVYS continues to maintain a low standard deviation – one-year standard deviation of 10.5% vs. benchmark of 11.4%, and the S&P 500 of 12.5%.

Figure 3: DIVYS Sector Weight v. S&P 500

Figure 3: DIVYS Sector Weight v. S&P 500

Source: Bloomberg

Portfolio Outlook

As we navigate a more fragmented macroeconomic environment, our focus remains on preserving income, managing risk, and opportunistically deploying capital into high-conviction names. With U.S. policy risk elevated and forward growth visibility clouded, we are maintaining a balanced allocation with an emphasis on defensive growth, diversified cash flows, and long-term capital return potential.

While President Trump’s “Liberation Day” tariff announcement came in higher than many anticipated, we remain cautious that potential trade negotiations or reversals could materialize in the near term. As a result, we continue to manage the portfolio from a relatively defensive posture, while maintaining the flexibility to adjust our exposure as the macro and political landscape evolves.

Importantly, our elevated cash position affords us the ability to act decisively. In fact, during early 2Q25, we have begun selectively redeploying capital into high-quality compounders trading at discounted valuations. These opportunistic moves reflect our belief that ongoing dislocations in pricing will reward disciplined, valuation-aware investors with a long-term focus.

We thank our clients for their continued trust and partnership. The DIVYS team remains steadfast in its commitment to prudent portfolio construction, thematic awareness, and risk-adjusted yield generation amid ongoing market uncertainty.

Important Disclosures:

Hilton Capital Management, LLC (“HCM”) is a Registered Investment Advisor with the US Securities Exchange Commission. The firm only transacts business in states where it is properly notice-filed or is excluded or exempted from registration requirements. Registration as an investment advisor does not constitute an endorsement of the firm by securities regulators nor does it indicate that the advisor has attained a particular level of skill or ability.

The views expressed in this commentary are subject to change based on market and other conditions. The document contains certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Sources include Bloomberg and INDATA (our portfolio accounting and performance system). There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All investing involves risks including the possible loss of capital. Asset allocation and diversification does not ensure a profit or protect against loss. Please note that out- performance does not necessarily represent positive total returns for a period. There is no assurance that any investment strategy will be successful. All investments carry a certain degree of risk. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited.

Additional Important Disclosures may be found in the HCM Form ADV Part 2A, which can be found at https://adviserinfo.sec.gov/firm/summary/116357.