HCM Insights

Navigating Economic Cycles for Better Investing

In today's dynamic investment landscape, change is the sole constant. Markets are experiencing turbulence due to uncertainty from fluctuating economic indicators and rapidly evolving global trends.

Specifically, the new administration's shifting tariff policies are fueling market volatility, adding to an already complex economic backdrop—characterized by slowing GDP growth, persistently sticky inflation despite normalization efforts, and a resilient labor market.

In our view, recurring tariff hikes could fuel persistent inflation over time. Meanwhile, delayed signs of labor market softening may complicate the Federal Reserve's ability to time rate cuts effectively, adding complexity to policy decisions.

Under the circumstances, knowing when and how to reposition a portfolio to optimize opportunities across the economic cycle requires a disciplined strategy centered on four areas:

- Understanding the economic cycle and its constituent phrases

- Identifying signals of phase changes

- Owning high-quality companies that are resilient to macroeconomic pressure

- Deploying flexible active management to effect portfolio readjustment

In this piece, we'll address these points while analyzing current economic data to explore whether a shift in the cycle may be near and what that could mean for our investment approach going forward.

The Economic Cycle

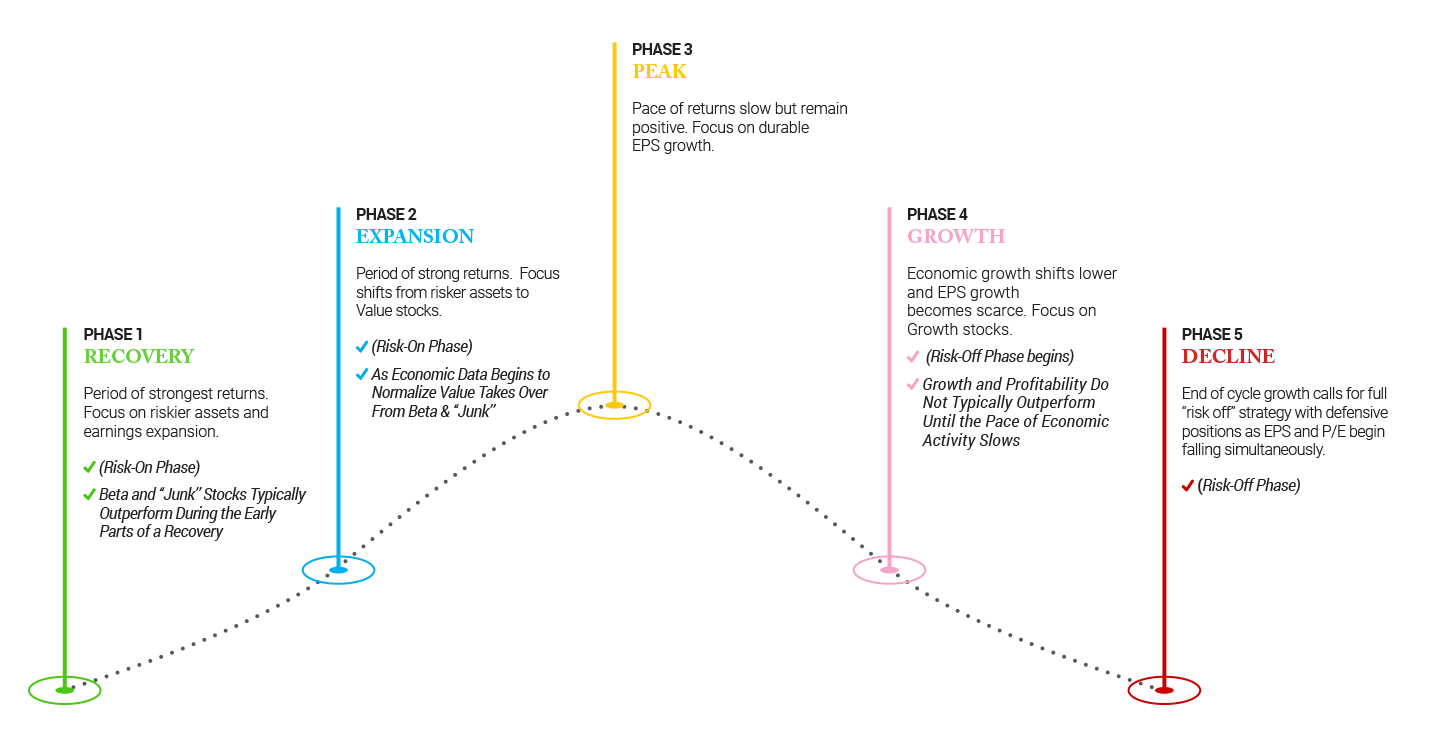

The economic cycle unfolds in five phases, characterized by varying levels of economic expansion or contraction: Recovery, Expansion, Peak, Growth, and Decline. And while no two economic cycles are the same, phase characteristics are analogous from cycle to cycle. A summary of the phases is provided below:

The Economic Cycle

The Economic Cycle

In any given phase, market returns will broadly reflect underlying strengths and weaknesses across sectors, shaped by the day’s combination of influences from central bank policy, government spending, global events, and other macroeconomic factors.

A successful investment approach requires a firm grasp of which phase is underway, related impacts, and how to allocate capital across assets and sectors within these conditions to optimize the opportunity for return and minimize losses.

Hilton Co-Chief Investment Officer Alex Oxenham underscores the point: “Long-term investment success hinges almost as much on avoiding losses as making gains. A disciplined approach to capital deployment within the economic cycle is key.”

Identifying Signals of Phase Changes

Anticipating shifts in phases means relying on objective data over sentiment or speculation, with accurate interpretation serving as a cornerstone of effective portfolio management during transitions. Successfully timing adjustments requires vigilant monitoring of economic indicators, recognizing trends, inflection points, and early warning signals of change.

This disciplined, data-driven approach cuts through market noise, providing the clarity needed to position portfolios advantageously as economic conditions evolve.

What Recent Data May Be Indicating

Recent economic indicators signal a decelerating economy, evidenced by downturns in retail sales, housing, and manufacturing output. This slowdown, coupled with erratic tariff policies and mounting recession concerns, triggered market turmoil earlier this week. The volatility pushed the Nasdaq and Russell 2000 indexes into correction territory—defined as a 10% or greater decline from recent highs—with the S&P 500 teetering on the brink of a similar fate.

Current economic data are outlined below.

GDP Growth

- The Philadelphia Fed projects 2.4% GDP growth for 2025, while the University of Michigan forecasts 1.8% for Q1 2025, down from 2.3% in Q4 2024.

- Softening consumer spending trends are a primary driver of the slowdown, following elevated activity in late 2024.

- A widening gap between U.S. manufacturing (slowing but positive) and services (growing) highlights deepening imbalances in consumer demand, business investment, and economic conditions.

Inflation

- Headline inflation rose in January but declined year-over-year. The Personal Consumption Expenditures (PCE) Price Index increased 0.3% for the month, matching December’s pace, while annual inflation eased to 2.5% from 2.6%.

- Core PCE, which excludes food and energy, also rose 0.3% for the month, yet with annual core inflation dipping to 2.6% from 2.9%.

- Consumers' short-term inflation expectations edged up in February, rising 0.1% to 3.1%, while medium- and long-term expectations remained steady at 3%.

Labor Markets

- Job growth has slowed but remains positive: February's 151,000 new jobs fell short of expectations (170,000) but exceeded January’s 125,000, signaling relative stability.

- February’s unemployment rate edged up to 4.1% from 4%, with leisure, hospitality, and retail shedding jobs while healthcare continued to expand.

- Federal job cuts are yet to be fully absorbed. Further layoffs, spending cuts, trade shifts, and immigration policy could dampen future job growth in the months ahead.

These are only a handful of data points, but, when read in concert and consistently, help illuminate changes and themes ahead.

“We review over 50 data points every month,” explains Oxenham. “The data tell the story, helping confirm where we are and where we’ll need to be. This enables us to pivot on the early side and optimize opportunity going forward.”

A Difficult Balancing Act for the Fed

Federal Reserve policy is also shaped by economic data, influencing decisions on interest rates and broader monetary policy. Given its significant impact, we also carefully examine Fed policy expectations alongside key economic indicators.

As such, the Fed currently faces an increasingly complex policy landscape. Repeated tariff hikes threaten to keep inflation elevated, yet the full scope and impact of the administration’s trade policies remain unclear. At the same time, the labor market appears to be moderating, but the extent and pace of the slowdown are challenging to gauge. Without clear signals, investors are left navigating an environment where policy missteps, unexpected economic shifts, or prolonged uncertainty could trigger further volatility.

Flexible Active Management to Effect Portfolio Readjustment

Today's market environment underscores the need for a disciplined and adaptable investment strategy. During periods of economic transition, heightened volatility demands thoughtful, data-driven decision-making to effectively navigate the uncertain landscape.

Active management provides the flexibility needed to respond to changing conditions, from identifying emerging opportunities to mitigating downside risks. At Hilton, we take a measured approach, ensuring portfolio adjustments are based on clear economic signals rather than short-term market noise.

When building long-term wealth, minimizing setbacks is as crucial as maximizing wins. By focusing on dynamic asset allocation and smart security selection, we seek to preserve capital while positioning for growth opportunities. In an uncertain economy, this flexibility ensures portfolios remain prepared for the next phase of the cycle—whatever it may bring.

Current economic conditions could suggest we are in a slower growth phase. Achieving return and limiting losses will likely be more challenging than in the recent past. As conditions shift, we will remain committed to vigilance, expert analysis, and disciplined decision-making, ensuring portfolio adjustments align with our macro framework and strategic investment approach.

By maintaining flexibility and a long-term perspective, we can adapt as needed while staying focused on delivering sustainable returns in an ever-changing market.

Contact Hilton today to learn more about how our unique management approach may assist in your investment decision-making, in down markets and throughout the economic cycle.

Important Disclosures:

Hilton Capital Management, LLC (“HCM”) is a Registered Investment Advisor with the US Securities Exchange Commission. The firm only transacts business in states where it is properly notice-filed or is excluded or exempted from registration requirements. Registration as an investment advisor does not constitute an endorsement of the firm by securities regulators nor does it indicate that the advisor has attained a particular level of skill or ability.

The views expressed in this commentary are subject to change based on market and other conditions. The document contains certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Sources include Bloomberg and INDATA (our portfolio accounting and performance system). There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All investing involves risks including the possible loss of capital. Asset allocation and diversification does not ensure a profit or protect against loss. Please note that out- performance does not necessarily represent positive total returns for a period. There is no assurance that any investment strategy will be successful. All investments carry a certain degree of risk. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited.

Additional Important Disclosures may be found in the HCM Form ADV Part 2A, which can be found at https://adviserinfo.sec.gov/firm/summary/116357.