HCM Insights

Are Earnings Estimates Too High?

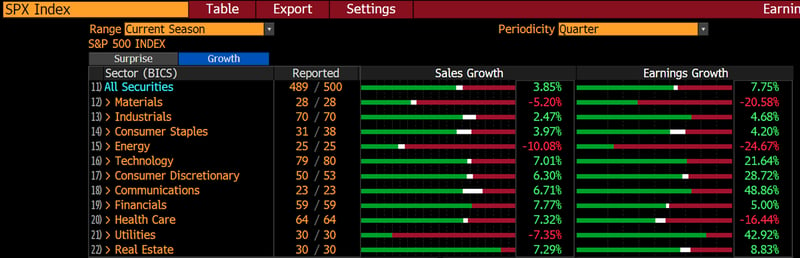

An Upswing in Q42023 Earnings

The Q423 earnings season has surpassed expectations, providing another catalyst to the equity markets. S&P 500 earnings growth was nearly 8%, a significant improvement over the expectations of 1.2%. Of the 97% of S&P 500 companies that have reported, 76% have had positive earnings surprises—outperforming the 10-year average of 74%.

Figure 1: S&P 500 Index (SPX) Year-on-Year Earnings Growth

As of 2/29/2024

Source: Bloomberg Finance L.P.

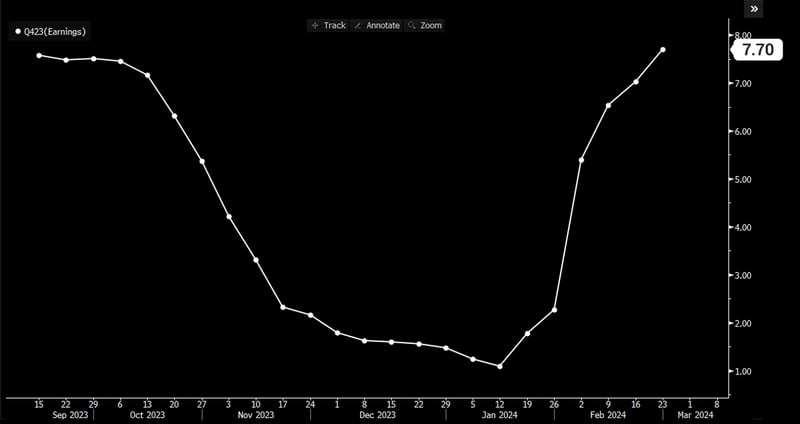

As Figure 2 illustrates, Q423 earnings estimates were reduced dramatically throughout Q4, as investors were skeptical corporations could combat a challenging inflationary environment.

Figure 2: S&P 500 Index Estimated 4Q2023 Year-on-Year Earnings Growth

9/1/23 - 2/23/24, Weekly

Source: Bloomberg Finance L.P.

The upside surprise to earnings reflects the impact of more robust economic growth and continued corporate strength. Companies have continued to combat a volatile macro backdrop by becoming more efficient—cutting costs and maintaining margins.

Concern regarding the longer-term effects of restrictive Fed policy (or its possible extension) has moderated in the face of solid progress on inflation, steady growth, resilient consumer demand, and a growing conviction that Fed rate cuts are soon ahead in 2024.

A constructive economic backdrop and solid forward earnings guidance from companies have created optimism around future earnings potential. Estimated annual growth of 9.5% for 2024 and 13.9% for 2025 herald a favorable market environment一if they can be achieved.

Figure 3: S&P 500 Index (SPX) Year-on-Year Earnings Growth

12/15/23 - 2/23/24, Weekly

Source: Bloomberg Finance L.P.

The earnings story for small caps, however, has been less rosy. With about 75% of the small-cap universe having reported, negative surprises outnumber positive ones, illustrating the sector’s vulnerability to higher interest rates and inflation. Indeed, the 4Q23 earnings estimate for the sector currently sits at a disappointing -7.2%.

Market Exuberance Continues

Meanwhile, the buoyant mood has largely kept the markets’ bullish narrative going, driving the S&P 500 to a high of 5000 last month. Recent bouts of choppiness have dissipated on the back of chip giant Nvidia’s massive forecast-beating 4Q23 results and the continued frenzy over artificial intelligence (AI). The Nasdaq and S&P 500 finished February at record highs, with both indexes lingering around 8% year to date, and the S&P 500 up 23% since its October 2023 low.

But, Proceed With Caution?

So while broad trends, according to Fed Chairman Powell’s January remarks, paint “a good picture so far,” the Committee is also focused on the sustainability of disinflation and the lingering potential for a reacceleration in inflation should rate cuts occur too soon. Recent hotter-than-expected labor market and steady inflation data has further justified the Fed’s wait-and-see approach.

Additionally, adjacent data hint at potential vulnerabilities that could dampen current optimism, suggesting the significant growth expectations already priced in could go either way. Consider these points:

Challenging Technicals

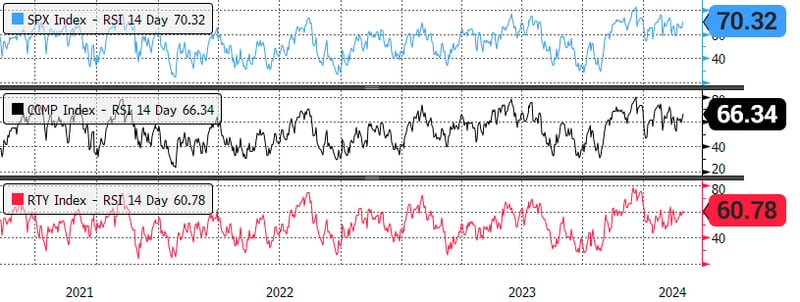

Price Change Momentum

Price change momentum as measured by the Relative Strength Index (RSI) has been trending up across markets.

On a scale of 0 to 100, an RSI measure of 70 or more signals overbought conditions, with assets possibly due for a price correction. A measure below 30 indicates oversold conditions, with assets possibly due for a price increase.

Recent reports show the S&P 500 (SPX Index) just inside overbought territory at 70.32, with the Nasdaq (CCMP Index) close behind at 66.34, and Russell 2000 (RTY Index) at 60.78.

Figure 4: Relative Strength Index: SPX, CCMP, RTY Indexes

5/10/21 - 3/1/24, Daily

Source: Bloomberg Finance L.P.

Narrowing Market Breadth

Recent indicators suggest that market breadth is narrowing again. This pattern echoes much of the S&P 500’s 2023 26%+ performance which was led by the Magnificent 7: Apple, Alphabet (Google), Amazon, Meta Platforms (Facebook and Instagram), Microsoft, Nvidia, and Tesla. During 2023, the Mag 7 returned a whopping 81.9% compared to the S&P 500’s 12.5% net of the cohort’s outsized contribution.

As illustrated in Figure 5 below, market breadth as measured by the comparison between the market-cap-weighted S&P 500 Index (SPX) and S&P 500 Equal Weight Index (SPW) is at its narrowest since 2009.

When a rally is supported by only a few large companies, it can make the overall market more vulnerable to volatility and downturns if those key stocks falter. The narrower the rally, the less chance it can be sustained.

Figure 5: S&P 500 Index (SPX) / S&P 500 Equal Weight Index (SPW)

2/16/07 - 3/1/24, Weekly

Source: Bloomberg Finance L.P.

Elevated Valuations

Equity market valuations are also pricey. The S&P 500 recently posted a price-to-earnings (P/E) multiple of 20.7x (as of March 1, 2024), well above the index’s ten-year average of 17.9x. Similar expansion can be seen in the tech-heavy Nasdaq at 29.1x, with only the Russell 2000 at its long-term average of 24.6x.

That’s not to say that valuations couldn’t expand further. The market could continue to climb if, for example, earnings continue their upward trend.

Figure 6: Monthly Historical 12-Month Forward P/E: SPX, CCMP, RTY Indexes

2/23/14 - 3/1/24, Monthly

Source: Bloomberg Finance L.P.

What About Those Longer-Term Earnings Estimates?

Referring again to Figure 3, a deeper look may require a more nuanced analysis. While expectations for 4Q23 have increased, quarterly figures for 2024 have been declining, yet still trend upward from 4.2% to 12.8% by year end. On balance, the earnings picture clearly shows solid signs of optimism, but volatility, too一perhaps with more to come.

What Lies Ahead?

An extended positive earnings outlook, compounded by a sustainably favorable macro backdrop and easy financial conditions could continue the optimistic trajectory and lift markets higher. However, flickers of uncertainty across the broader economic landscape could also belie greater risk ahead.

At Hilton, the path forward will require navigating the delicate balance between accessing growth opportunities, when and where appropriate, and exercising caution in the face of increased volatility and unsettled conditions, all within the context of our macro framework and disciplined investment and portfolio construction processes.

As always, we will continue to rely on our vigilance, expert analysis, and strategic decision-making in the face of evolving market dynamics.