HCM Insights

The Tortoise and the Hare: DIVYS Q4 23 Review

The Year of the Rabbit

In 2023, the Gregorian calendar was designated the year of the rabbit—a symbol of good fortune and rebirth. Perhaps, then, it’s no surprise 2023’s markets closed in a similarly spirited fashion. Fourth quarter returns leaped happily to a banner finish, dodging a handful of obstacles and threats along the way.

More broadly, the whole of 2023 unfolded to reveal gradually improving sentiment, thanks to careful maneuvering from the Fed: The Committee’s thoughtfully timed and ‘just right’ rate hikes throughout the year continued to dampen inflation while avoiding further economic peril in the wake of the March bank crisis.

The markets, further buoyed by growing consumer resilience and the prospect of sooner-than-expected rate cuts, were effectively reborn—rallying into year-end and closing the chapter on what was an impossible-to-forecast yet fortuitous rabbit-y (or hare-y) year.

That said, during times like these we’re reminded that a dividend-oriented strategy looks more like a tortoise, moving slowly and steadily in pursuit of the hare.

How the Tortoises Fared

With rate hikes on the back burner and adjustments to higher rates baked in, the dividend-payers also celebrated. As mentioned, the growing narrative of a Fed pivot created a strong “everything rally” to close out the year, with the Dividend Achievers Index returning +9.8% in Q4.

Furthermore, the Dividend Achievers matched the nine-week positive run of both the S&P 500 and Nasdaq, a feat achieved only 12 times by any U.S. equity index since 1960.

Hilton’s Dividend & Yield Strategy

Over the year, Hilton’s Dividend & Yield Strategy (DIVYS) shifted to a less defensive bias, reflecting the likely end of rate hikes and growing probability of rate cuts.

As a reminder, the strategy remains focused on high-quality names with limited levels of leverage. Additionally, rate of change remains at the forefront of our investment ethos. That is, sectors and companies inflecting for the better—whether improving from good to better or from bad to less bad.

Overall, we see various investment opportunities here: chip cycle inflection, input costs rapidly decreasing in line with inflation, and a more resilient consumer. On the downside, we see incremental risks in high fixed-cost manufacturing and sticky higher wages.

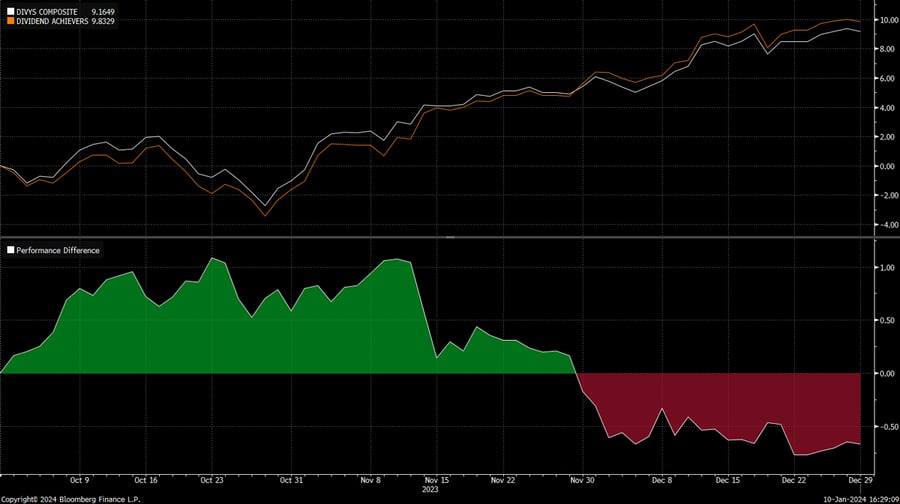

For 2023, DIVYS produced a gross return of +11.04% versus the Dividend Achievers Index return of +11.92%. During Q4, the strategy produced a gross return of +9.19% versus the Dividend Achievers Index return of +9.83%, an underperformance versus the benchmark* of 64bp gross and 75bp net. This was due to the portfolio’s lag during the markets’ December rally, which overshadowed its relative outperformance during the first two months of the quarter when the markets sold off.

Figure 1: Absolute & Relative Performance vs Benchmark Q423

Source: Bloomberg

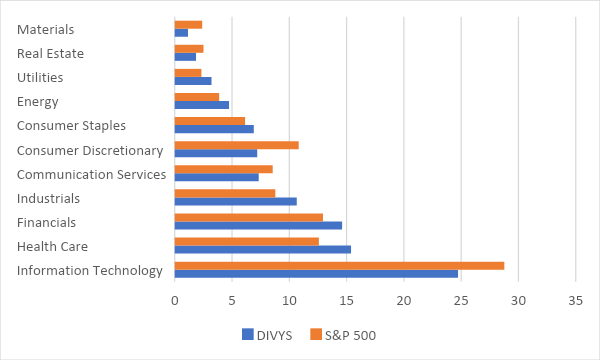

Figure 2: Q3 Portfolio Sector Weightings vs S&P 500

Source: Bloomberg

A Snapshot of Q4 attribution:

- Average allocation to cash decreased slightly to 2.2% (2.3% in Q323) as various portfolio changes generated and subsequently used cash.

- Yield on the portfolio as of 12/31/2023 was 2.07% and the beta was .89.

- The Dividend and Yield Strategy returned +9.19% gross /+9.09% net, which was -64bp and -75bp behind the benchmark* return of +9.83%.

- Relative to the Nasdaq US Broad Dividend Achievers (DAATR), DIVYS was overweight communication services, consumer discretionary, and health care technology, and underweight consumer staples, financials, industrials, and materials.

- Relative to the Nasdaq US Broad Dividend Achievers (DAATR), DIVYS outperformed in communication services, technology, consumer discretionary and health care.

- Top single-name contributors included MSFT, AAPL, AVGO, ACN and QCOM.

- Top single-name detractors included XOM, CVX, CSCO, WMT and BDX.

- Relative to the S&P500, DIVYS shifted to a more neutral position Q/Q and is now overweight financials and industrials. DIVYS remains underweight technology, but reduced the size of the underweights to consumer discretionary, and communication services relative to last quarter.

- New positions added during the quarter: MDC, DRI, TGT, WFC, NTAP, PSA.

- Positions sold during the quarter: WMT, CBU, RHHBY, ADP, CWEN, CME.

Rundown of 2023 Attribution:

- Top single-name contributors included AAPL, ARES, RSG, COR, and ACN.

- Top single-name detractors included AVGO, ORCL, USB, NEE, and CWEN.

- The Dividend and Yield Strategy returned +11.04% gross /+10.61% net, which was -88bp and -131bp behind the benchmark* return of 11.92%.

- The DIVYS strategy continues to maintain a lower standard deviation vs the benchmark*—one-year standard deviation of 10.2% vs the benchmark* at 11.0%. The standard deviation contracted further on a sequential basis.

Twenty-twenty-three proved to be a challenging year. Despite growing expectations for a “Goldilocks” or soft-landing scenario, it’s difficult to shake the uneasy feeling that the Fed’s rate-hike cycle may ultimately end elsewhere.

Bottom line: We feel more confident about the direction of inflation and growth and continue to monitor the Fed's plans. The Hilton Investment Committee remains patient, with a focus on economic data and the broader macro landscape, and will act accordingly. As clearer signs of a major cycle turn emerge, we can and will do more. Until that point, as always, we remain vigilant.