HCM Insights

Immigration & the Labor Market

A healthy labor market, which often includes significant immigrant participation, is crucial for a flourishing economy characterized by steady and sustainable growth with relatively low inflation. The central bank’s (the Fed’s) dual mandate, to achieve maximum employment and price stability, is in service to keeping the economy on such a footing over time.

When inflation is held in check, purchasing power is preserved, which can lead to stronger consumer demand, greater business investment, and hiring.

Immigration can impact this flow by influencing labor market supply, productivity, wage growth, and job creation. To better observe this in practice, we can look at our current economic cycle, where the effects of immigration are visible at several points.

Slowing Immigration Initially Contributed to Inflation

Rapidly rising inflation emerged in 2021 as the effects of post-pandemic supply chain dislocations and surplus fiscal stimulus took hold.

Subsequent shutdowns and truncated employment rolls also proved consequential once consumer demand roared back a few months later. This disconnect between pent-up demand and contracting labor supply further contributed to rising price levels.

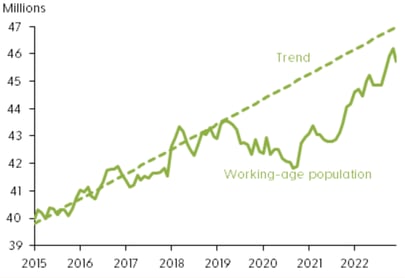

Part of the decline in employment was due to slowing immigration in the years before the pandemic. Research from the Federal Reserve Bank of San Francisco indicates that in 2017, growth in the foreign-born, working-age labor force slowed significantly to 1.5 million people below what would have been predicted by its growth trend over the previous six years (2010-16). The gap widened to 2 million people by the close of 2021.

Figure 1: Contributions to Working-Age Population

Source: Federal Reserve Bank of San Francisco

When businesses reopened, employers struggled to hire enough personnel to meet demand, especially in restaurants, hotels, retail stores, and construction sites, sectors often staffed by migrant labor, adversely affecting prices.

For Now, Inflation Is Moderating

Over the last two years, however, the gradual resolution of supply chain kinks, restrictive moves by the Fed, and reductions in labor shortages appear to have dampened inflation for now. Since its high in June 2022, inflation has moderated from a 9.1% annual rate to its most recent reading of 3.2% for February 2024.

And while millions of native-born Americans have returned to work一helping close labor demand-supply gaps一rebounding immigration has also had an impact: Since 2022, immigration has reversed its downward course, nearly closing the population gap with its pre-pandemic growth trend.

Labor Markets Remain Tight

Strength in the labor markets has also been helped by "a strong pace of immigration," as Fed Chairman Powell recently noted. Benefits have manifested in several ways.

As mentioned, an increase in the supply of workers has gradually helped bring broader supply-demand imbalances back in line, further dampening inflation without significantly quashing growth.

To wit, while GDP growth is expected to decline from 2023’s 3.2% level, the Fed recently revised its median growth projections up to 2.1% for 2024 and 2% for 2025 and 2026一due, in part, to more robust labor supply data.

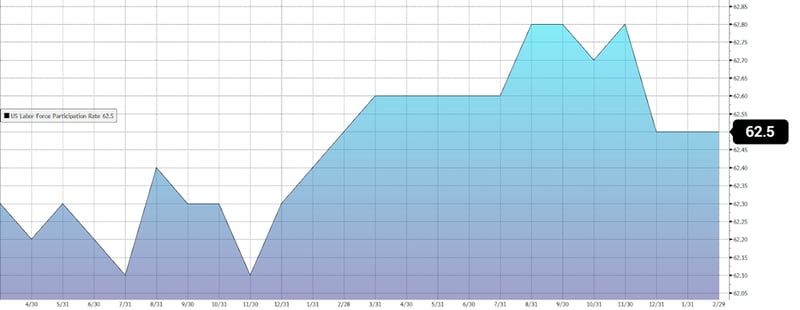

This is seen in the U.S. labor force participation rate, which remains at 62.5% for a second month running, a level significantly higher than its pandemic-era lows yet leveling out closer to its longer-term average.

Figure 2: U.S. Labor Force Participation Rate

March 27, 2022 - February 29, 2024, Seasonally adjusted

Note: The labor force participation rate is the sum of persons looking for work (employed and unemployed) as a percentage of the total working-age population.

Source: U.S. Bureau of Labor Statistics, Bloomberg Finance, L.P.

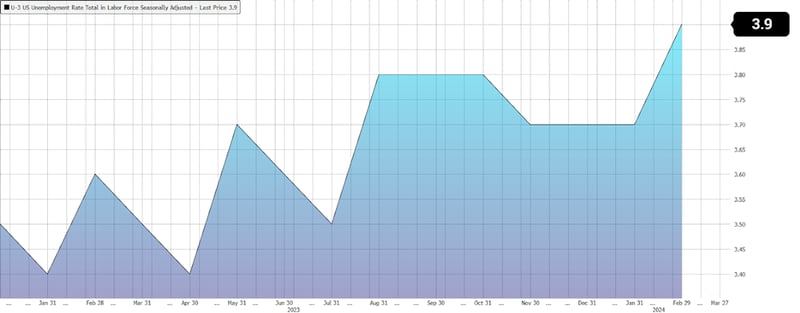

The recent uptick in the unemployment rate also underscores this trend. In February 2024, it rose to 3.9% from the previous month's 3.8%. However, it remains below 4% at near historic lows.

Figure 3: U.S. Unemployment Rate

December 31, 2022 - February 29, 2024, Seasonally adjusted

Source: U.S. Bureau of Labor Statistics, Bloomberg Finance, L.P.

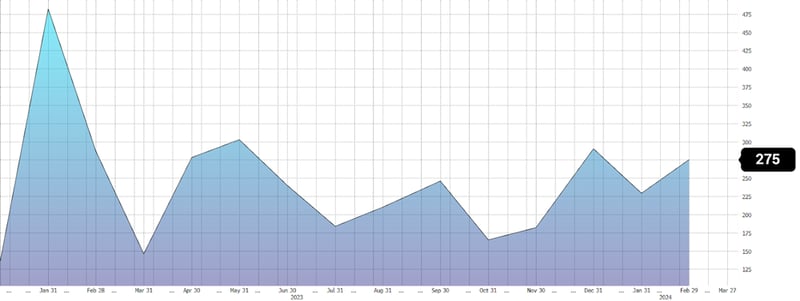

Importantly, the increased supply of workers, including immigrants, has also helped fuel job creation in the face of strong consumer demand. Employers added 275,000 jobs in February, the third consecutive month of seasonally adjusted gains above 200,000 and 38th consecutive month of growth.

Figure 4: U.S. Employees on Nonfarm Payrolls

December 31, 2022 - February 29, 2024, Seasonally adjusted

Source: U.S. Bureau of Labor Statistics, Bloomberg Finance, L.P.

What About Wage Inflation?

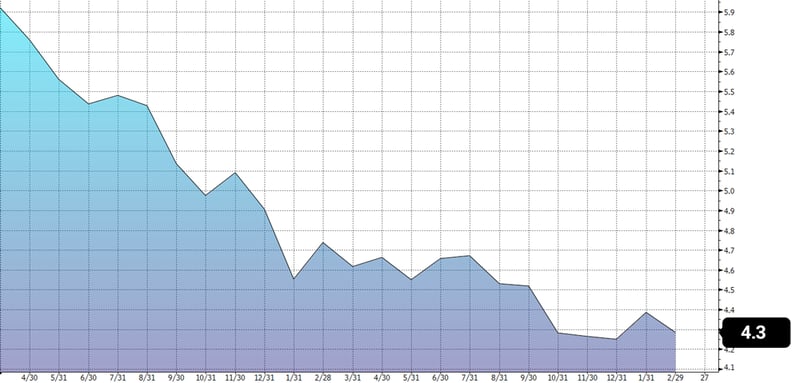

While we’re still experiencing strong wage growth, it, too, is moderating to more sustainable levels. As seen in Figure 5 below, the increase in average hourly earnings is trending downward, now at 4.3% and closer to a 3.5% level consistent with the Fed’s 2% target inflation rate.

Figure 5: U.S. Average Hourly Earnings All Employees, Year-on-Year % Change

March 27, 2022 - February 29, 2024, Seasonally adjusted

Source: U.S. Bureau of Labor Statistics, Bloomberg Finance, L.P.

Hiring and quit rates, both harbingers of increased wage growth, are also normalizing in the wake of post-pandemic highs.

That said, while excessive wage growth can make inflation stickier, a more moderate level can help the economy. When wages increase, spending also rises, which can lead to higher demand and a requisite boost in economic activity.

Immigration can amplify this effect. Immigrant participation in the workforce adds to consumer spending and demand, which, when met with improving supply-side conditions, can result in greater productivity overall.

In effect, immigration can help resolve supply side constraints while contributing to demand and job creation, resulting in an expanding economy without overly increasing prices.

What Lies Ahead?

Recent trends showcase the effects of immigration flows on the labor market and adjacent impacts on inflation and economic activity. Indeed, it’s evident that the Federal Reserve monitors this data set among many others.

As the economy continues to evolve, these trends can provide insights to help inform policy development going forward. Consistent with its measured approach, we expect the Fed to continue to evaluate the sustainability of inflation and labor trends, including immigration, as data becomes available.