HCM Insights

SMCO Q1 24 Recap: Pushing Through the Market Square

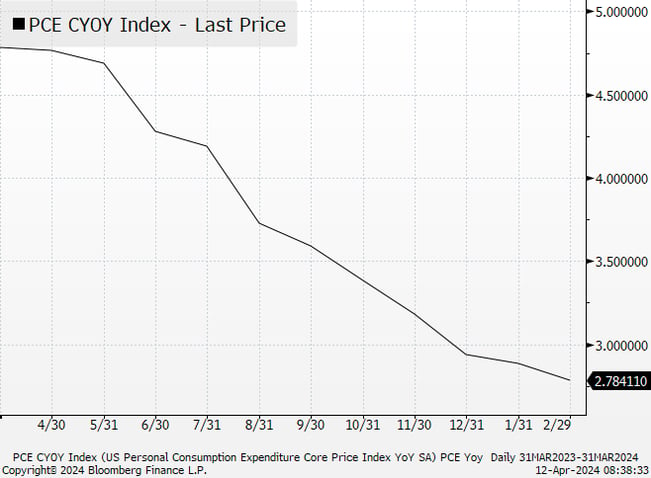

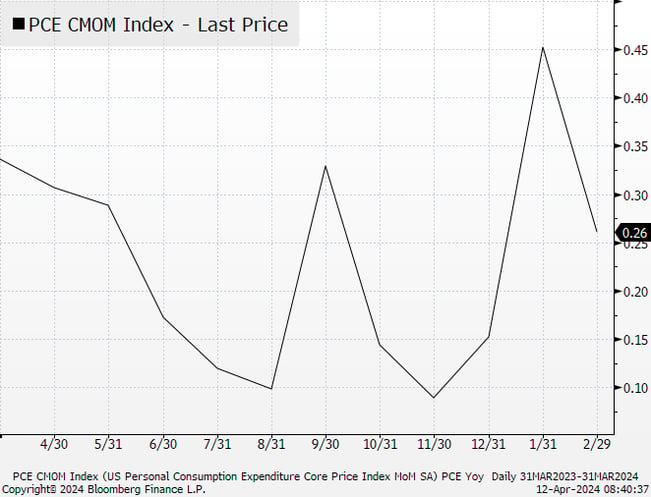

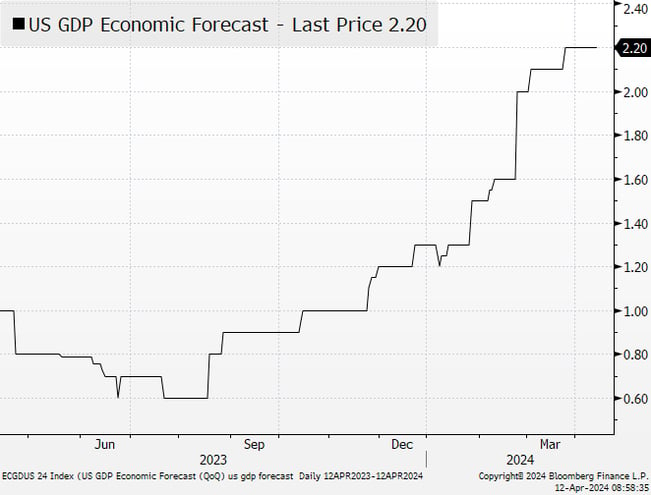

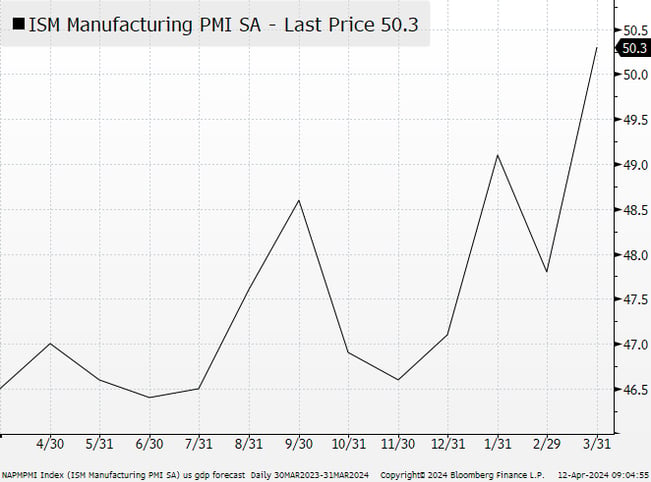

The release of The Rise and Fall of Ziggy Stardust and the Spiders from Mars in 1972 proved pivotal for David Bowie, boosting his career into interstellar overdrive. As I started to think about writing this quarter’s letter the opening track, “Five Years,” came to mind. With SMCO hitting the five-year mark using the song’s title as a musical tie-in seemed like a no-brainer. But the song is about an impending apocalypse - thankfully NOT our current market outlook! The opening line of the song, however, does serve as an apt title for this quarter’s missive, and bears relevance to the first few months of 2024. Investors were pushing through a market square of sorts, a market of competing narratives. One narrative told of several rate cuts on the way, in the immediate future. Another more tentative one had inflation concerns keeping the Fed at bay, potentially depriving the stock market of a rate-cut driven boost. Each time an inflation reading came in hot this narrative got a little more airtime, and the market freaked out. Yet another storyline, the one we subscribe to, points to a constructive path forward. It involves a surprisingly resurgent economy, with inflation heading lower but with bumps along the way. Other elements of the environment - stronger growth readings and an improving earnings outlook - suggest an overall healthy backdrop.

The Year Over Year PCE

Chart Looks Good…

…But the Month Over Month Chart Keeps Investors On Edge

Getting Better: Expected 2024 GDP Growth Improving

And Recently The ISM Has Improved To Above 50 After A Long Period Below

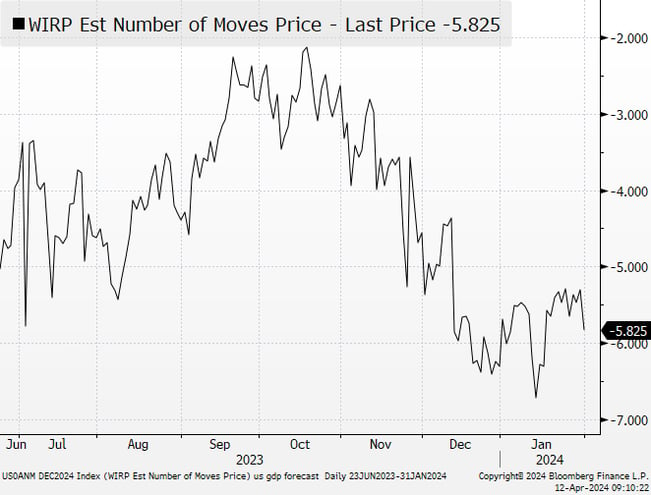

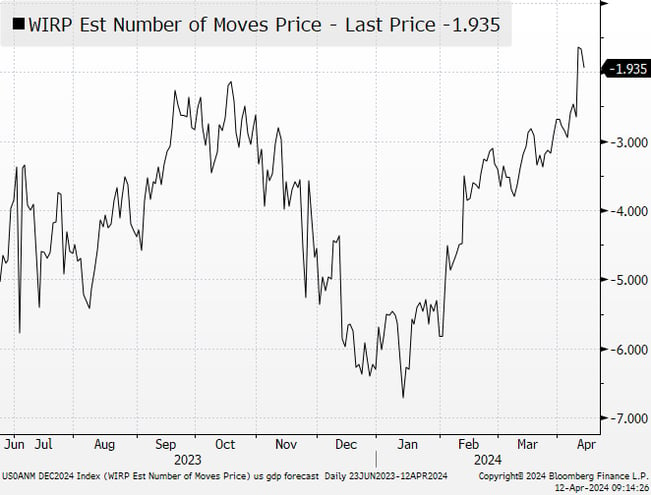

Through late January the market saw several rate cuts…

…But hot inflation readings tamped down expectations

Putting it all together we see the potential for equity markets to go higher, more reliant on improving business fundamentals than juice from the Fed. The prospect of a couple of rate cuts in the indefinite future is sufficient, with the Fed being supportive but not overly accommodative. This combination would create a positive, not euphoric, market in which companies delivering earnings can be rewarded.

Since quarter-end, high inflation readings have markets churning again, but the needle hasn’t moved enough for us to change gears. We analyze and assess each economic tick, but take a longer view. We stay the course for now, with vigilance critical as always.

First Quarter SMCO Review

The smid-cap market idled in January and then resumed its move higher for the last two months of the quarter. Unlike the “everything rally” of late 2023 the first quarter brought a more selective climb. True, most stocks were higher, but companies exhibiting strong results outperformed the others. Uncertainty regarding the number and timing of rate cuts stifled the “rising tide” for all stocks. Additionally, the macro and micro news was more good than bad. Aggregate growth mostly came in better than expected, and a solid earnings season spurred stocks on. The yin of improving fundamentals to the yang of anticipated rate cuts produced a market we were pleased to see. Late quarter Fed commentary restoked the rate-cut hoopla which dented our relative lead, but nevertheless we finished ahead for the quarter. SMCO advanced +11.2% (gross)/+11.1% (net) besting the 6.9% return of the Russell 2500.

First Quarter 2024 Recap |

Q124 Absolute Performance by Sectors

|

Stock Level Contribution

|

Q124 Relative Performance by Sector

|

In 1Q24 SMCO saw positive returns in all sectors except Real Estate and Utilities. Nearly half the portfolio’s gain emanated from the somewhat catch-all Industrials sector. The top five contributors included EMCOR, SAIA and nVent in Industrials, Ralph Lauren in Discretionary and MKS Instruments in Technology. The largest detractors were Americold in Real Estate, Wolfspeed in Technology, Avanos in Healthcare, Clearway Energy in Utilities and Simply Good Foods in Staples.

Activity was limited in the quarter, with turnover below 2% for the quarter. We entered the quarter well positioned, and no new names were added to the portfolio. Only one position, Avanos, was fully eliminated due to fundamental disappointment.

Back To The Opening Track on Ziggy: FIVE YEARS

We were tantalizingly close to hitting our five-year anniversary when we last wrote in January, but it was satisfying to finally cross the finish line. The event was made sweeter by a quarter of solid returns that helped put our 1-year, 3-year, 5-year (yes we have one now!) and inception-to-date returns ahead of the benchmark.

In early 2019 we launched SMCO, modeling it closely on the strategy we had managed for several years. At that time, we made some minor changes and enhancements to the process, and over the last five years we have continued to fine tune our approach. Markets evolve, and if you don’t evolve as a portfolio manager you likely will struggle. But while process can be tweaked, we believe adhering to an underlying philosophy is critical for success: If you have an approach that works stick with it. Chasing whatever is working at any moment is a recipe for disaster.

While Bowie’s “Five Years” was the countdown to an imaginary ending, it’s quite the contrary for us. We see this “Five Years” as marking just the beginning of what will be a long run. We are energized by the prospects of managing client assets for many years to come.

Thanks for reading.