HCM Insights

SMCO Q2 24 Recap: R(AI)se the Roof

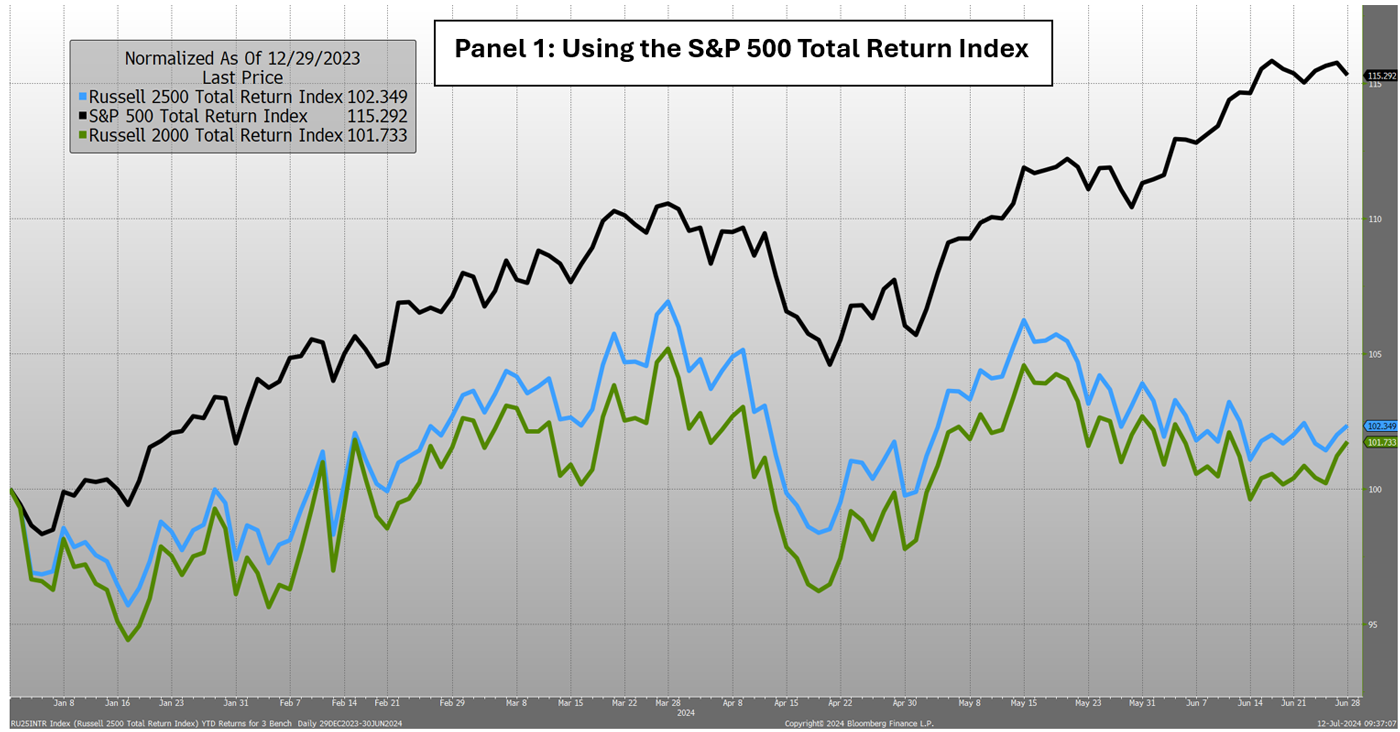

Using the S&P Total Return Index

Using the S&P Total Return Index

Source: Bloomberg

As an investment team, we constantly seek to garner a holistic view of the investment landscape. We meticulously analyze various types of data, including macroeconomic indicators, fixed income, equity, and other markets. For the management of SMCO, an equity-only product, we take particular note of the equity market commentary. In our view, it has become increasingly difficult to talk about “the” market as one monolithic entity. As the year-to-date graph shows, the S&P 500 has significantly diverged from the small & mid-cap markets, with the gap widening further in the second quarter of 2024. The default explanation is that economic uncertainty makes large caps more attractive than the more economically sensitive small and mid-cap stocks, with current conditions suggesting we are in an extended late-cycle phase. However, as shown in Panel 2 below, the Equal-Weighted S&P 500 paints a very different picture.

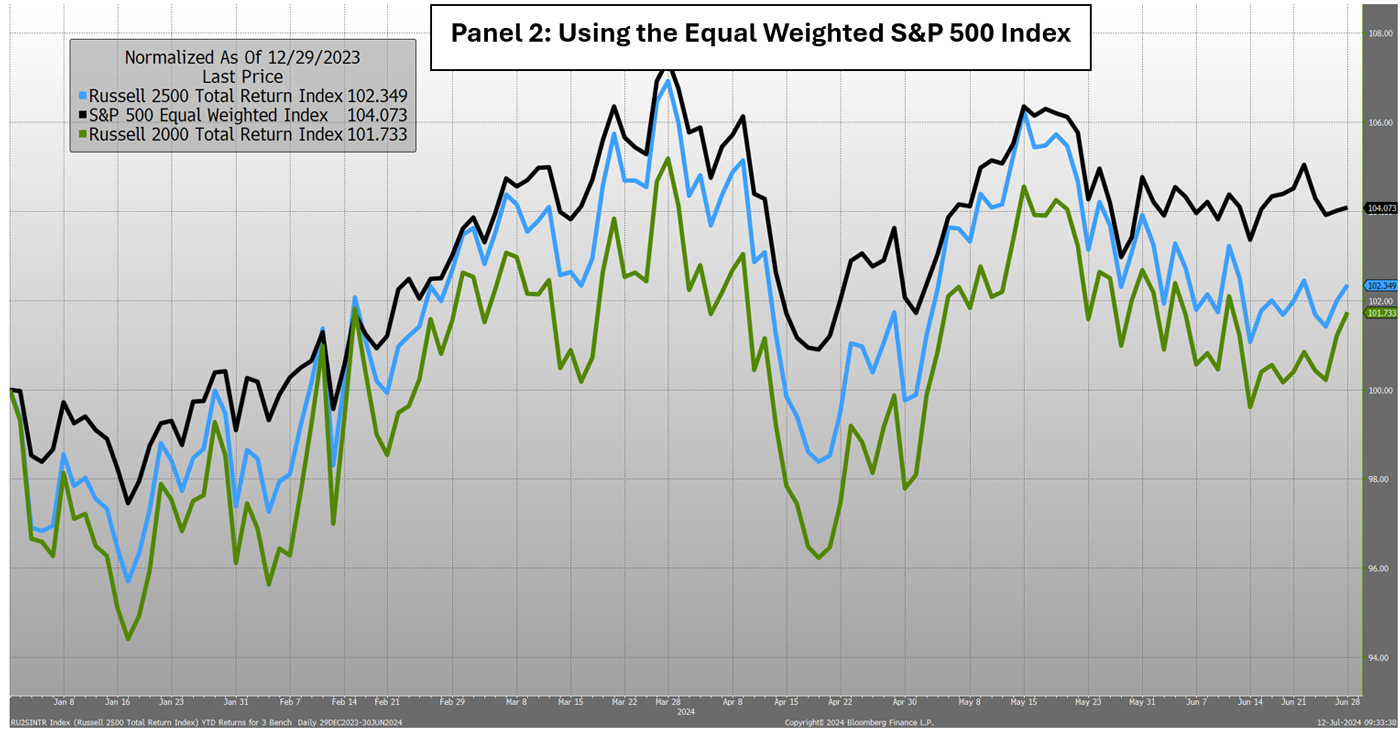

Using the Equal Weighted S&P 500 Index

Using the Equal Weighted S&P 500 Index

Source: Bloomberg

The primary difference between Panel 1 and Panel 2 is that the outsized impact of the AI-powered mega-cap tech stocks has been removed. This narrow group of stocks continues to materially outperform the broader market, driving the majority of the S&P’s +4.3% second quarter gain. This narrowness, not particularly healthy, is of particular relevance to those of us who traffic in small and mid-cap stocks, having created somewhat of a false dichotomy. The divergence is not so much large vs. small, but rather the “AI Names” vs. all other stocks. In this light, the underperformance of small and mid-cap stocks is less dramatic, with the Equal Weighted S&P’s drop of -3.1% being not too far off Russell 2500’s decline of -4.3% in Q2. Our market segment, while down, has not been materially weaker than the broader tape. We see recent market action as a result of general uncertainty, not necessarily indicative of nearing the end of an economic cycle. The ongoing debate of growth vs. inflation vs. rates continues, and the next few months may prove pivotal. Growth is slowing, but inflation is also coming down. Rates are restrictive, but the odds of cuts are rising given the moderating growth and weakening labor market. The backdrop still looks constructive to us, but we concede that the next few readings will be key. The Fed has to thread the needle: inflation must stay tame, and growth can moderate but not collapse…

Like (a) Madman Across The Water: SMCO 2Q24 Review

Elton John’s fourth studio release, Madman Across The Water, is widely considered a classic. A recently purchased copy of it has been in heavy rotation, and upon getting reacquainted with it, it’s clear why it holds such a status: the combination of timeless hits and “deep tracks” that satisfy even the most hardcore fans. Songs like “Tiny Dancer,” “Levon,” and the title track are recognizable to even casual listeners. However, the album’s 45 minutes also include gems like “Razor Face,” “Holiday Inn,” and “Rotten Peaches,” which, while not household names, are absolutely fantastic tunes.

We wouldn’t want Q2, a down quarter, to be seen as a “classic” SMCO quarter, but the collection of positive contributors does reflect the big hits plus deep tracks recipe. Names such as Clean Harbors, Dycom, and Primoris were direct plays on the highly visible themes of digital and physical infrastructure spending—the big hits, if you will. But then some more obscure names, such as the IBM spinout Kyndryl and the emerging grocer/food retailer Sprouts Farmers Market, had good runs in Q2. These more idiosyncratic winners, the deep tracks if you will, also made meaningful contributions. We see room for both thematic and company-specific stories in SMCO, and it was nice to see contributions from both in the quarter.

There were, of course, some drags in the quarter as well, with DigitalBridge, SAIA, and RH causing the most damage. Near-term fundamental disappointment was the common theme, but we remain committed to these stocks. In the case of DigitalBridge, we used the weakness to add to our position. We still see a compelling investment case as the company transforms from an unfocused real estate concern into a specialized alternative asset manager. We anticipate SAIA’s margins will recover as the company capitalizes on recent market share gains, which should result in a higher earnings run rate over time. Lastly, RH continues to struggle with weak end markets, testing our confidence, but for now we have stayed with the position. Lower rates could spur more interest in their product offerings; they have been investing while others have retreated. The company could be rewarded with greater market share and higher earnings when its market returns to health.

For the quarter, SMCO declined -1.57% gross/-1.77% net, outperforming the Russell 2500 which declined -4.27%. This put the year-to-date performance at +9.41% gross/+9.14% net, significantly ahead of the Russell 2500’s gain of +2.35%. Once again, the quarter demonstrated the value of active management broadly and our strategy specifically. The current volatile environment increases scrutiny on company results, and the combination of better earnings growth and reasonable valuations is being rewarded. During this uncertain market phase we are pleased with our current holdings, as evidenced by portfolio turnover of less than 2% for the quarter.

Second Quarter 2024 Recap |

2Q24 Absolute Performance by Sectors

|

Stock Level Contribution

|

2Q24 Relative Performance by Sector

|

Outlook

Reflecting on our thoughts at the end of the first quarter, the second quarter proved bumpier than we had expected or wanted. Disappointingly, most small/mid cap stocks struggled given the economic and market uncertainty. On the positive side, fundamentals mattered, and good companies outperformed. The overall outlook remains murky, with the Fed seemingly now more focused on the employment side of its mandate. The economy is slowing, and there is concern it will slow too much, with high inflation preventing the Fed from cutting rates. This scenario could lead to a weaker economy, causing stocks to continue to struggle. However, if inflation readings continue to cool that would enable the Fed to cut rates, resulting in moderated growth with lower rates. This would be a “good enough” backdrop for our approach, and we see potential in the small and mid-cap asset class. For the longer term, we continue to see value in our approach. A return to ZIRP seems unlikely, and our ability to identify better companies may add significant value.

Thank you for you continued interest in SMCO. Please reach out for more information.

All information set forth herein is as of June 30th, 2024, unless otherwise noted. This letter contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed herein will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Hilton Capital Management, LLC (“HCM”) is a registered investment adviser with its principal place of business in the State of New York. For additional information about HCM, including fees and services, send for our Form ADV using the contact information herein. Please read the Form ADV carefully before you invest or send money. Past performance is no guarantee of future results. All information set forth herein is estimated and unaudited.

Please see the Small & MidCap presentation which contains full performance information as well as relevant legal and regulatory disclaimers.