HCM Insights

SMCO 3Q 25 Recap: Take a bow for the new revolution – Side Two of Who’s Next

Music references have become a staple of these letters. When we reflect on the prior quarter, a song title, lyric, or tone often captures our message. As we began drafting the third-quarter review, something unexpected happened: we found an entire album side whose sequence provides a clear framework for our thoughts. The Who’s Who’s Next is an iconic record, and the song progression on the second side offers surprising parallels to this year’s equity markets, if you allow us some poetic license.

Track One: “Getting in Tune”

Third quarter and year-to-date performance review

The first half of 2025 traced a sharp V-shape for small- and mid-caps: a meaningful drawdown followed by a nearly as steep rebound. A buildup of tariff and policy risk, peaking on “Liberation Day,” catalyzed the pullback. Prospective tariffs threatened to worsen already softening fundamentals, and investors stepped back from the uncertainty. Yet the data held up and corporate results arrived better than feared, leaving the small/mid cap market roughly flat at midyear. The speed of the decline made outperformance difficult, but we still eked out a small relative lead in the first quarter. Anticipating a quick recovery, we avoided moving into full “bunker mode” during the downturn. That decision proved fortunate, allowing us to participate in the snapback, modestly extend our relative lead, and enter the third quarter with a small absolute gain.

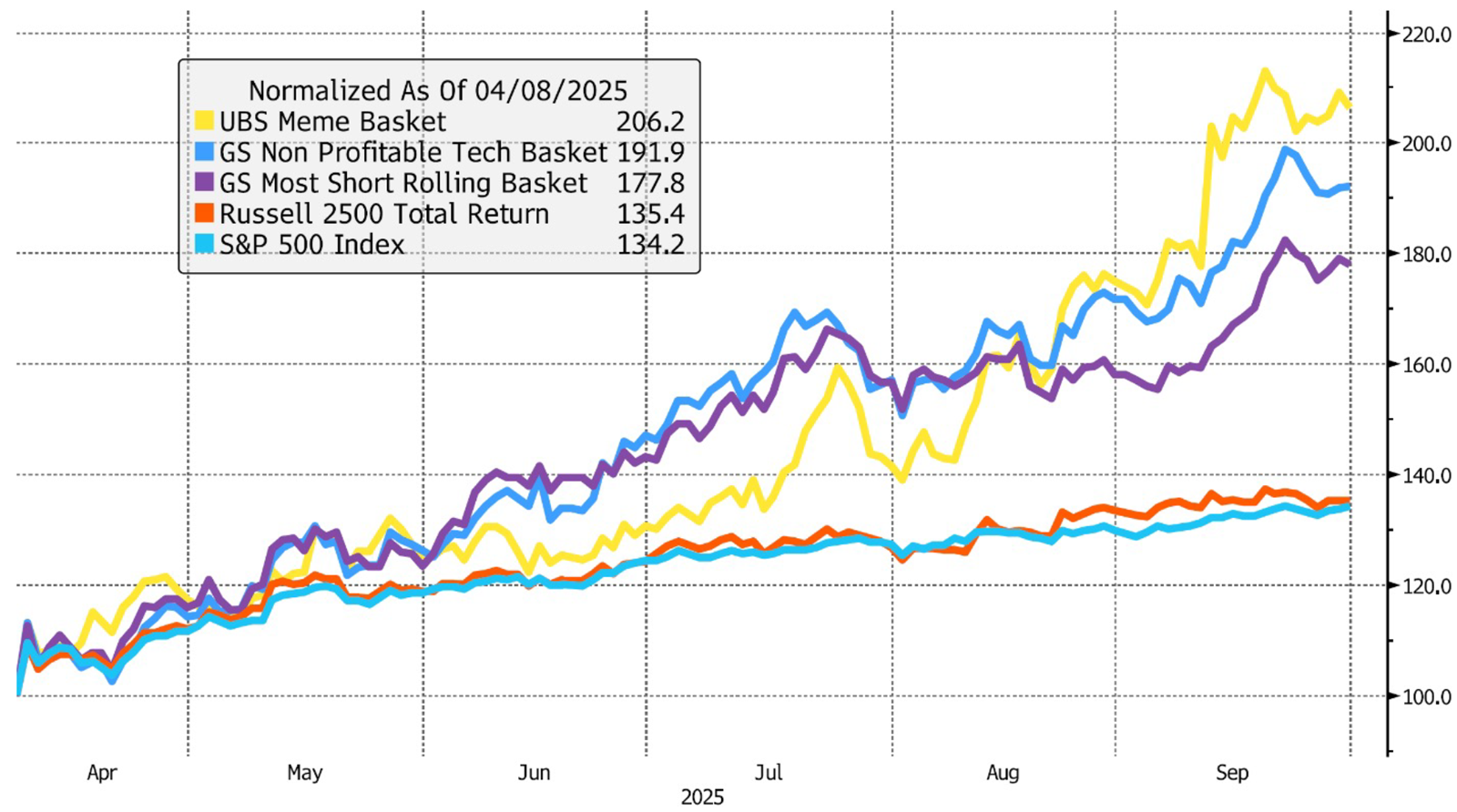

The third quarter opened in a choppy holding pattern, with little progress in the first month. As rate-cut expectations rose, strong second-quarter earnings and resilient macro data lifted markets, and the Russell 2500 advanced nearly 9% for the quarter. Leadership was concentrated in lower-quality cohorts: non-earners, unprofitable growth, highly levered, and heavily shorted stocks. Because we emphasize quality and have limited, if any, exposure to those groups, staying level with the index in a rally like this was a tall order. This pattern was visible not only in August and September but also from the Russell 2500’s bottom on April 8, as the chart shows.

Source: Bloomberg, As of 9/30/25

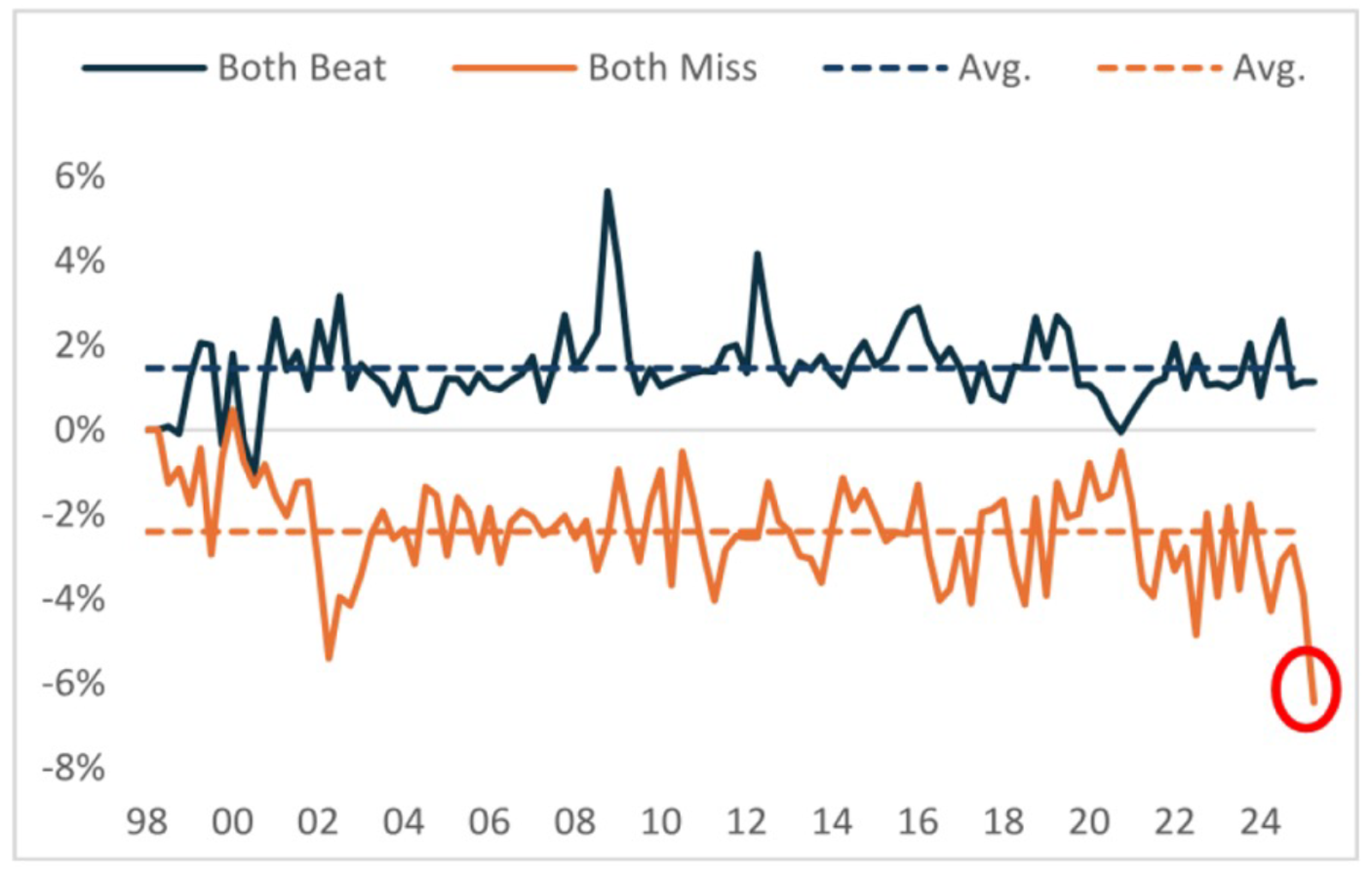

Additionally, while the rally’s leadership explains much of the challenge in keeping pace, a few holdings delivered disappointing earnings in the third quarter. That is part of a bottom-up process; over short windows, a small number of detractors can weigh on results. This quarter was especially unforgiving, with earnings misses penalized more than usual, as the next chart illustrates.

Misses Penalized More Than Ever in 2Q25

1D earnings reaction vs. SPX co's that beat/missed both sales & EPS

Misses Penalized More Than Ever in 2Q25

Source: Wells Fargo Securities, LLC, FactSet. As of 9/15/25

In sum, the SMCO composite returned +5.2% gross and +5.0% net in the third quarter, trailing the Russell 2500’s +9.0% gain. Entering the period with a small lead, the SMCO composite stands at +6.6% gross and +6.2% net year to date through September, a bit closer to but still behind the Russell 2500’s +9.5%. The market took time to “get in tune” this year; as the noise faded and fundamentals improved, leadership skewed toward lower-quality segments where our exposure is limited. Even so, we stayed in tune with the recovery rather than shifting to an overly defensive stance, which allowed us to participate in the upside while maintaining the quality discipline that defines SMCO.

Track Two: “Going Mobile”

Portfolio changes and current positioning

“Going Mobile” captures what we have done in the portfolio over the past several months. We still aim to own long-term secular winners, but delivering attractive risk-adjusted returns also requires owning companies positioned to benefit from today’s market and economic tailwinds. This is not about chasing short-term trades; it is about including businesses advantaged by near-term trends we view as durable. Our process remains disciplined yet flexible, and we have made corresponding adjustments to the portfolio.

Since the first quarter, our risk tolerance has risen alongside the market. We have increased exposure to risk-on and cyclical names and tilted toward smaller-cap companies. At the sector level, we raised Consumer Discretionary and Energy weights and reduced Staples. At the stock level, we trimmed several winners and initiated positions in YETI, Academy Sports & Outdoors, Taylor Morrison, and TETRA Technologies.

Track Three: “Behind Blue Eyes”

Reflection of changes made during the last few months

“Behind Blue Eyes,” our third song, captures the consternation we have felt this year as markets shifted and investor sentiment turned. When our ongoing read of market and business conditions points to a need for adjustment, we act, but only within our discipline. We look for ideas that achieve the positioning we want, and each must still meet our investment criteria. We can loosen the risk calipers when prudent, yet we do not stray from our principles. That approach makes idea selection harder, but it is how we maintain consistency and a steady long-term profile.

Positive developments have created their own consternation. To preserve a consistent profile, we often trim winners as their risk-reward changes. It is more art than science, and while it can leave some gains on the table, it helps keep risk in line and encourages healthy rebalancing into new ideas or underweighted holdings. Recently, our AI-related names (NVT, CIEN, PRIM, etc.) have materially outperformed. We want to stay engaged with this important trend while managing aggregate exposure. As we harvest gains, we redeploy into areas with better risk-reward, positioned to complement existing holdings and enhance overall portfolio balance. These companies may not show the same fundamental surge as AI-related names, but lower valuations can compensate, and even modest fundamental improvements can drive solid results. Not every addition fits the pure high-quality compounder profile, but remaining competitive across market phases supports attractive over-the-cycle outcomes.

Track Four: “Won’t Get Fooled Again”

Looking forward

The album side closes with the anthemic “Won’t Get Fooled Again,” a great classic rock song if you’re not familiar. Curiously, the idea of not “getting fooled” applies to our current market thoughts in two ways.

First, investors have shifted to a risk-on posture in a still unsettled world, and market participation has broadened, a constructive backdrop for small and mid-caps. As is typical early in this phase, leadership has tilted toward lower-quality and higher-risk stocks. We have adjusted to this reality, but many variables remain in play, including tariffs, mixed economic and labor data, and the potential impact of a government shutdown. Our near-term task is to calibrate portfolio risk up or down as the fundamentals evolve.

Second, we want to avoid getting “fooled” by the AI cycle. The buildout is a major driver of market returns and a meaningful contributor to growth, and it is spurring significant investment. When one theme powers so much of the market, investors need to pay close attention. A speculative bubble may be forming, though its duration is uncertain. Even if it persists, our aim is to participate without becoming over-concentrated. We aim to benefit from the theme while maintaining balance, with careful attention to position sizing, valuation discipline, and total portfolio construction.

What happened to Lifehouse?

The Who released Who’s Next in 1971, shortly after the success of their “rock opera” Tommy. The band’s leader, Pete Townshend, had begun an ambitious follow-up, Lifehouse, but the project stalled and Who’s Next emerged from its strongest material. That arc offers a fitting parallel for 2025: the market has navigated a volatile stretch with multiple hurdles and delivered respectable results. Importantly, market participation is widening, earnings have been more resilient than feared, small and mid-caps still trade at a historical discount to large caps, and secular investment in AI, infrastructure, energy, and reshoring is underpinning demand. With inflation off its highs and the rate backdrop showing signs of stabilization, corporate balance sheets are positioned to support ongoing investment. Challenges remain, but these dynamics provide credible reasons for optimism. Just as The Who shaped a classic from a period of uncertainty, we believe there is room for markets to build on recent progress as fundamentals and participation deepen.

Important Disclosures:

Hilton Capital Management, LLC (“HCM”) is a Registered Investment Advisor with the US Securities Exchange Commission. The firm only transacts business in states where it is properly notice-filed or is excluded or exempted from registration requirements. Registration as an investment advisor does not constitute an endorsement of the firm by securities regulators nor does it indicate that the advisor has attained a particular level of skill or ability.

The views expressed in this commentary are subject to change based on market and other conditions. The document contains certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Sources include: Bloomberg. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The performance information contained herein is unaudited, was calculated by HCM and is shown on both a gross-of-fee and net-of-fee basis. The performance results herein include the reinvestment of dividends and/or other earnings, and the net-of-fee performance results are shown net of the actual advisory fees paid by the client accounts in the HCM SMID Cap Composite. In addition, actual client accounts may incur other transaction costs such as brokerage commissions, custodial costs and other expenses. Accordingly, actual client performance will differ, potentially materially, particularly given that the net compounded impact of the deduction of investment advisory fees over time will be affected by the amount of the fees, the time period, and the investment performance. For additional information about the composite, please contact us - info@hiltoncm.com

All investing involves risks including the possible loss of capital. Asset allocation and diversification does not ensure a profit or protect against loss. Please note that out- performance does not necessarily represent positive total returns for a period. There is no assurance that any investment strategy will be successful. All investments carry a certain degree of risk. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited.

Additional Important Disclosures may be found in the HCM Form ADV Part 2A, which can be found at https://adviserinfo.sec.gov/firm/summary/116357.