HCM Insights

Labor Loosens Up

The lower-than-expected monthly job growth report released on May 3 further bolsters the growing narrative that the labor market, while robust, is showing signs of loosening.

Though inflation lingers at a current annual rate of 2.8% (as measured by the Core PCE Index, which omits the more volatile costs of food and energy), somewhat above the Fed’s stated 2% target, the recent confluence of a slowing job market and immigration strength is helping dampen the risk of an overheating economy and inflationary resurgence, at least for now.

However, as Fed Chairman Powell reiterated earlier last week—prior to the disclosure of this month’s payroll figures—the Committee will continue to depend on empirical data to affirm the sustainability of an inflation decline before relaxing its restrictive policy stance.

“Still,” says Hilton Co-Chief Investment Officer, Alex Oxenham, “the softening employment picture could be a critical piece of the inflation-routing puzzle.”

The Data

Recent easing in the labor market, while subtle, suggests a developing trend toward normalization amid the tight conditions that have defined the post-pandemic period.

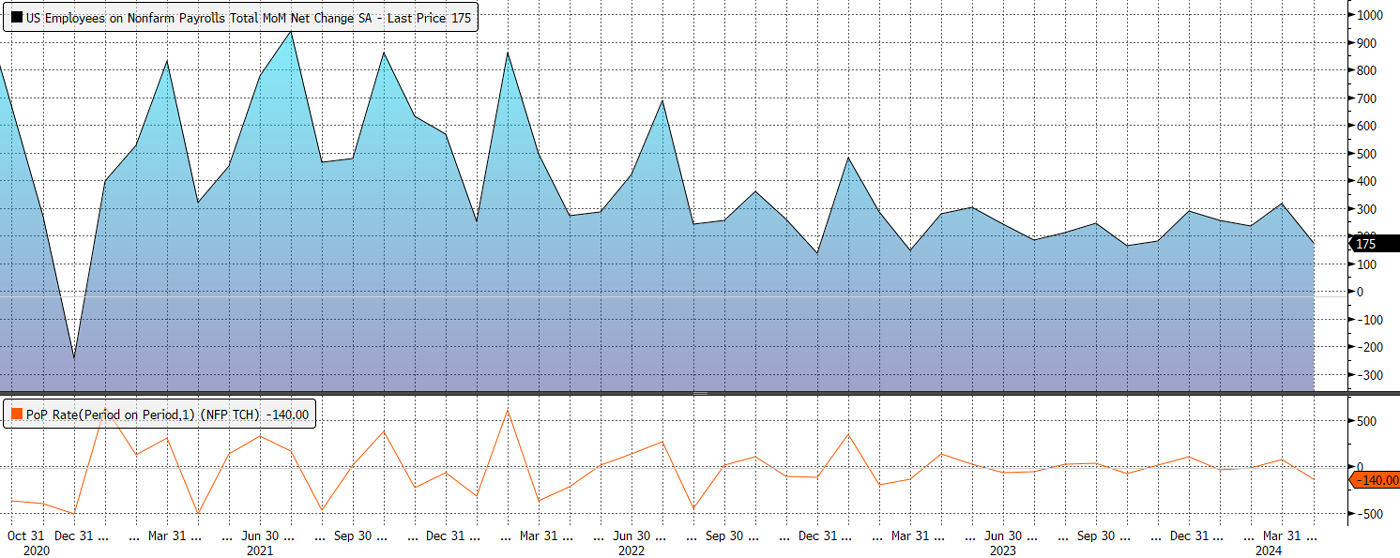

April’s nonfarm payroll report, a key economic indicator of job growth, reported 175,000 new jobs for the month, short of the 240,000 jobs expected and well below March’s total of 300,000. The unemployment rate also ticked up slightly to 3.9%, though still at a historic low below 4%.

U.S. Total Nonfarm Payroll Employment, SA

October 31, 2020 - March 31, 2024

U.S. Total Nonfarm Payroll Employment, SA

Source: Bloomberg Finance L.P., U.S. Bureau of Labor Statistics

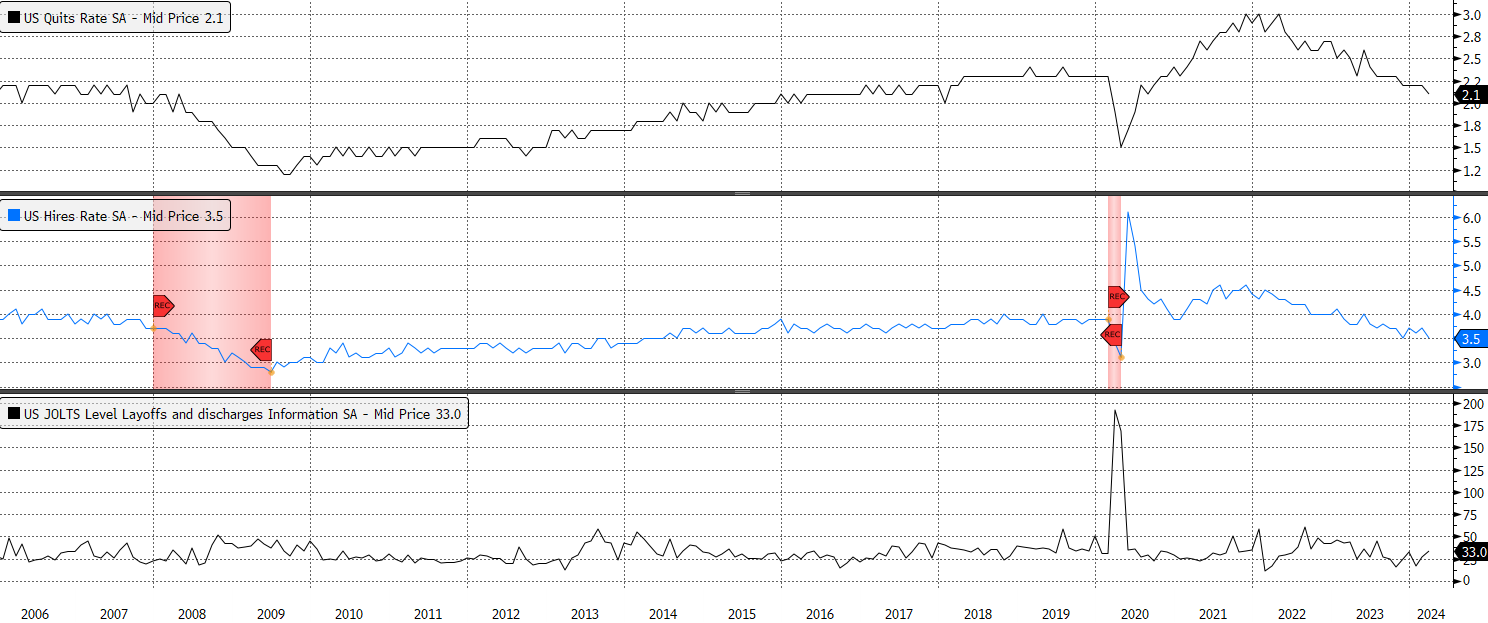

Several other labor market metrics are also showing signs of softening:

- Quits are on the decline. March’s 2.1% reading falls just under the previous month’s 2.2% rate and is approaching pre-COVID levels.

- The hiring rate is also trending down, declining from 3.7% in February to March’s 3.5% level, somewhat lower than pre-COVID levels.

- Job openings decreased to 8.5 million, a decline from the previous month and a continuation of a broader downward trend.

- Jobless claims rose to its highest level in more than eight months to 231,000 last week.

Taken together, these points could hint at businesses' increased hesitation to expand their workforce and lower employee confidence in securing better opportunities elsewhere.

U.S Data on Quits and Hires, SA

December 31, 2005 - May 6, 2024

U.S Data on Quits and Hires, SA

Source: Bloomberg Finance L.P., U.S. Bureau of Labor Statistics

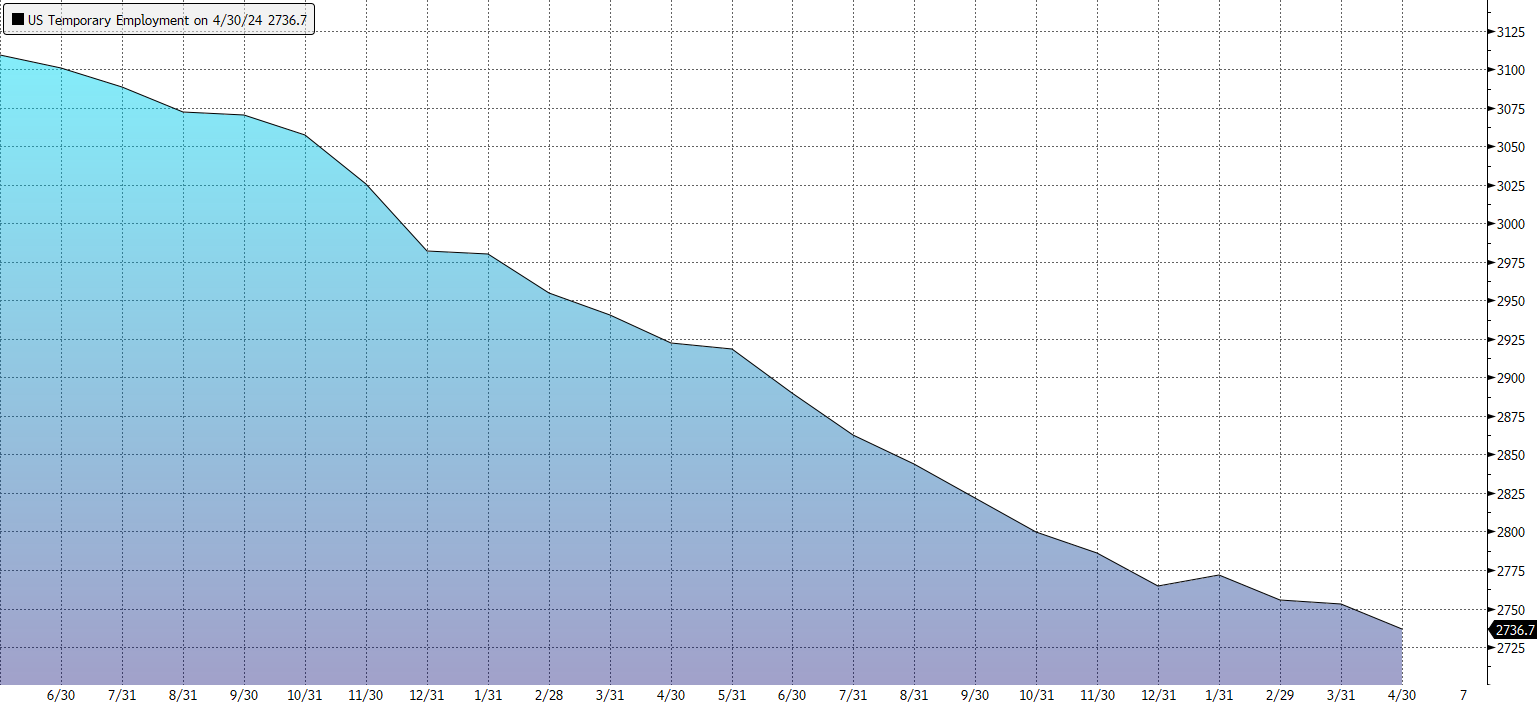

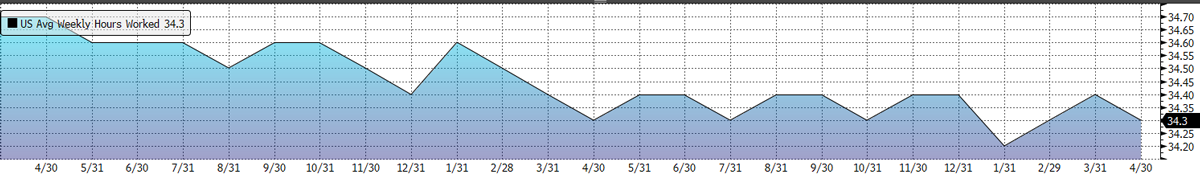

Additionally, cutbacks in temporary labor and average weekly hours worked indicate businesses are beginning to adjust to moderating economic growth.

U.S. Temporary Employment, SA

USESTEMP Index | May 7, 2022 - May 7, 2024

U.S. Temporary Employment, SA

Source: Bloomberg Finance L.P.

U.S. Average Weekly Hours Worked, SA

March 27, 2022 - May 6, 2024

U.S. Average Weekly Hours Worked, SA

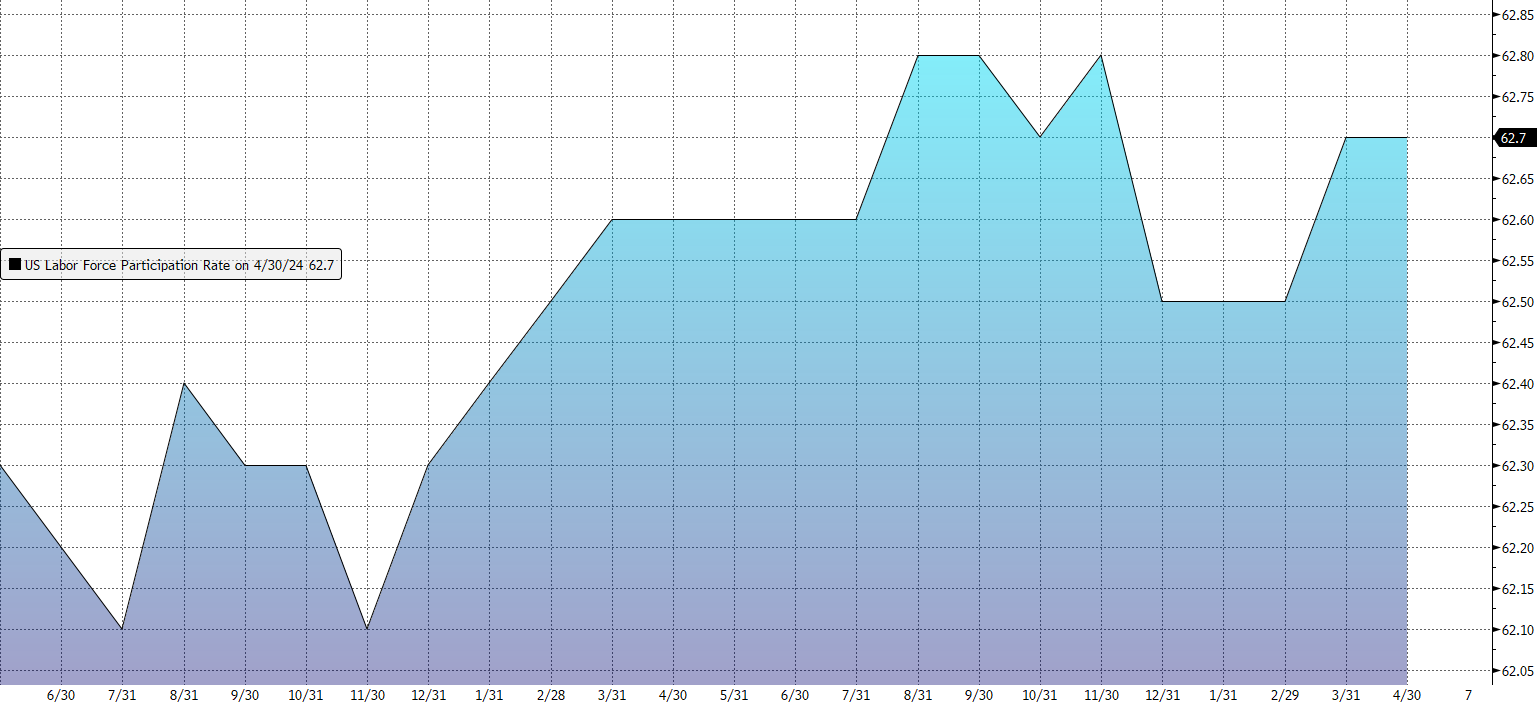

That said, the Labor Force Participation Rate remained stable at 62.7% in April一the third such month of the rate running near its longer-term average一supporting the view that the labor market retains underlying strength.

U.S. Labor Force Participation Rate, SA

May 7, 2022 - May 7, 2024

U.S. Labor Force Participation Rate, SA

Source: Bloomberg Finance L.P., U.S. Bureau of Labor Statistics

The Role of Immigration

The strong pace of immigration over the last two years has played an important role in this loosening narrative, boosting the labor supply to better balance employee shortages while contributing to consumer demand. (See our blog, Immigration & the Labor Market, for more details.)

This balance is crucial, as it has supported continued economic growth by keeping consumer spending robust, even as it added more workers to the labor pool一a trend evident in the growing labor force participation rate discussed above.

The Impact on Wage Growth

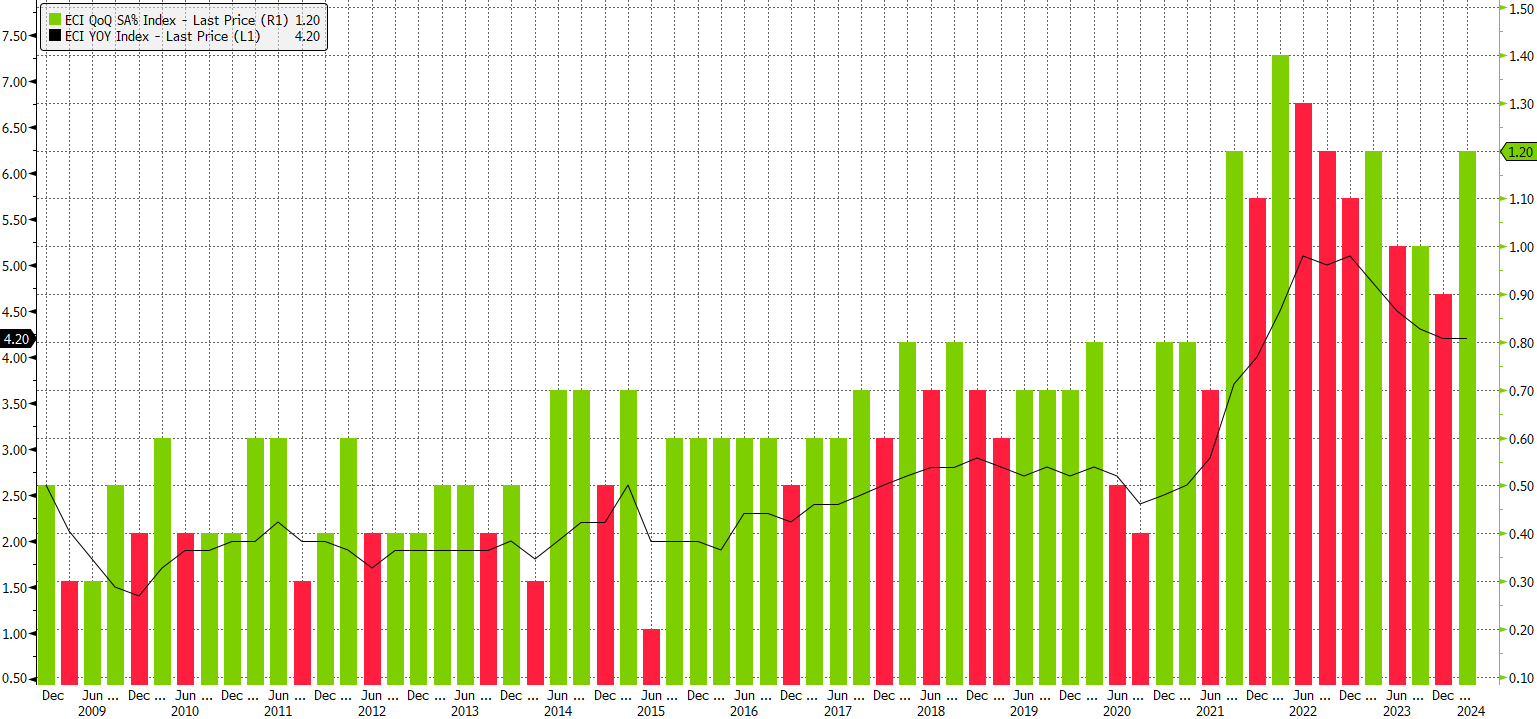

Wage growth, to some extent, remains sticky. While trending down from its recent growth peak of 5.5% in June 2022, the Employment Cost Index rose by an annual rate of 4.2% for the quarter ending March 31, 2024, a measure that has largely remained unchanged since December一and still above pre-pandemic levels by about 1%. Additionally, the index quarterly growth rate accelerated to 1.2% relative to the 0.9% rise observed in the previous quarter.

Employment Cost Index, SA

October 31, 2008 - April 30, 2024 | Annual % Change (Left Axis), Quarterly % Change (Right Axis)

Employment Cost Index, SA

Source: Bloomberg Finance L.P., U.S. Bureau of Labor Statistics

To be sure, progress has been made, but as Chairman Powell recently underscored, further declines are needed despite the potential for more bumps along the way.

In theory, a loosening labor market could be the initial catalyst that helps shift wage growth off its current perch. Consistent declines in job growth in the face of increasing labor participation could help depress wage inflation by simple supply-demand dynamics.

Finally, What About Inflation?

The Fed’s dual mandate of achieving maximum employment and price stability underlies the connection between the two. Tight labor conditions can lead to competition among employers for workers, resulting in wage inflation. When excessive, wage growth can aggravate broader inflationary impulses.

Alternatively, when pressure on hiring eases, and labor conditions loosen, wage growth can slow, helping draw down inflation over time.

Thus far, inflation has moderated substantially over the last year, remarkably perhaps, without triggering a recession. Among other factors, the influx of immigration helped bring labor supply and demand closer to equilibrium, helping fuel a positive feedback loop of robust consumer demand, and by extension, strong economic growth.

But there’s still ground to cover. “The last mile of beating inflation is likely to be more difficult than the bulk of what was accomplished last year,” Oxenham notes.

It’s possible the current labor market trends offer a potential pathway toward further inflation reductions, though it may be too soon to say with certainty.

We at Hilton will continue to monitor the sustainability of inflation and labor trends as new data emerges. Another crucial employment report is expected before the Committee’s mid-June meeting. Ultimately it will be necessary to observe how these factors affect the economic landscape, the markets, and inflation going forward.